Last week a hawkish Federal Reserve broadcasted a conflicting message to investors. Well, don’t be confused by the FedSpeak. Easy money is hear to stay. To be clear, easy money policies by the Federal Reserve is a key reason why the current bull market continues to surge higher with no end in sight.

Regardless, for those investors hiding in cash and bonds, inflation continues to erode any resemblance of true value. Near term, any pull back in cyclical or technology stocks is an opportunity to buy. Generally speaking, as long as dividend yields exceed the US 10-year US treasury yield, stocks are going higher. Period. Full stop.

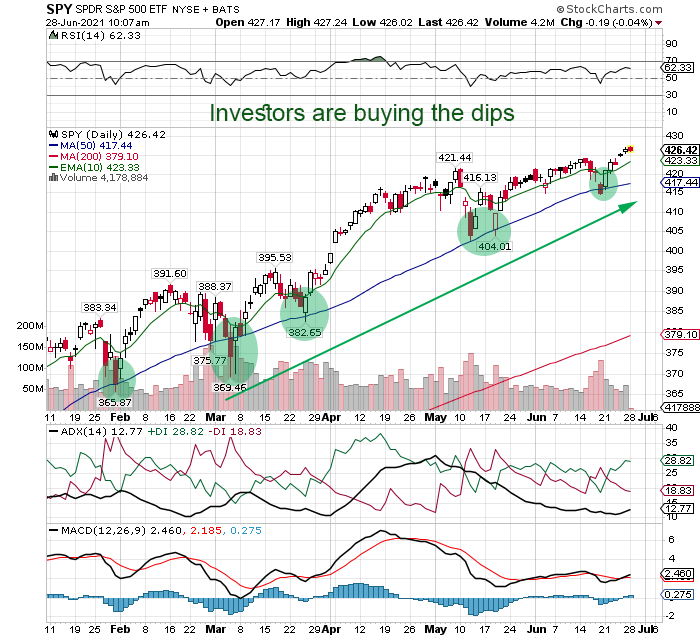

2021 Easy Money – The Year To Buy The Dips

Without doubt the Federal Reserve will continue to support the stock market. Surely, last week Jerome Powell, the Fed Chairman, gave all 23 of the largest US banks the green light to resume dividends and re-start stock buy back programs.

Unquestionably this is bullish for stocks.

Conclusion

In the end, unseasoned investors continue to get frazzled when the Federal Reserve issues any statement. For example, the Fed is talking about higher interest rates two years into the future. But, interest rates have fallen since April. Surely, smart investors realized this move lower in rates would mean more mortgage refinancing and cheaper money. Ultimately a boost to the stock market.

No doubt, it’s beyond me how this setup became bearish for stocks in the eyes of Financial TV, like CNBC and Bloomberg. Well, talking heads have an agenda to push the narrative of the day, even if it leads investors in the wrong direction.

Regardless, investors should remain focused on what’s working, namely technology stocks.

Now, be sure to check out the Ultimate Portfolio + page. Here you will find great stocks that are beating inflation big time!

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved