Technology stocks rocket higher once again. But, is there room to run higher? Savvy investors have been riding the technology trade since the Tech Bubble.

Fortunately, the technology bull run is just getting started. As a matter of fact, the digital transformation that’s sweeping the globe is just the beginning.

Ironically, it was a global pandemic that kick started the digital transformation.

Undoubtedly, earning estimates by Wall Street analysts will undershoot. What’s more, seasoned investors know that new and unknown revenue streams are going to be massive.

Top Technology Stocks

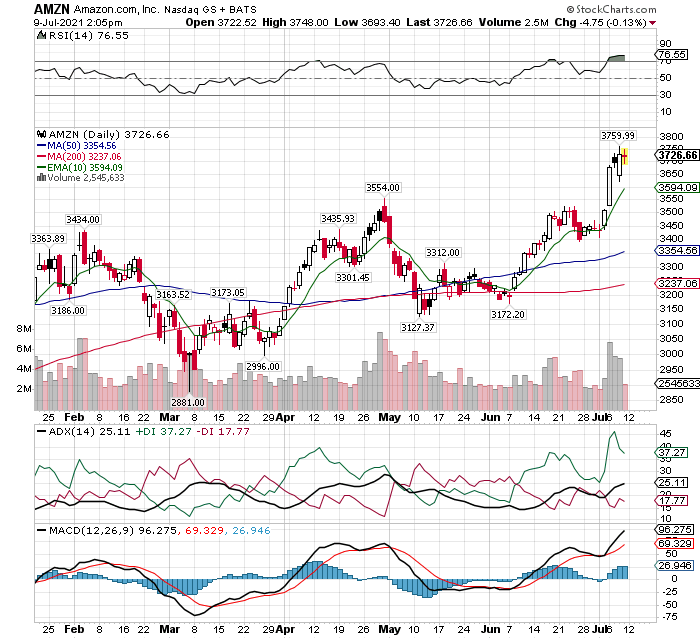

Amazon.com Inc. (Nasdaq: AMZN)

Amazon.com is a critical provider of digital infrastructure and a dominant player is global e-commerce. As well as a remarkable story of a company focused on growing earnings.

To be sure, Amazon.com is a buy on pullbacks and near term weakness.

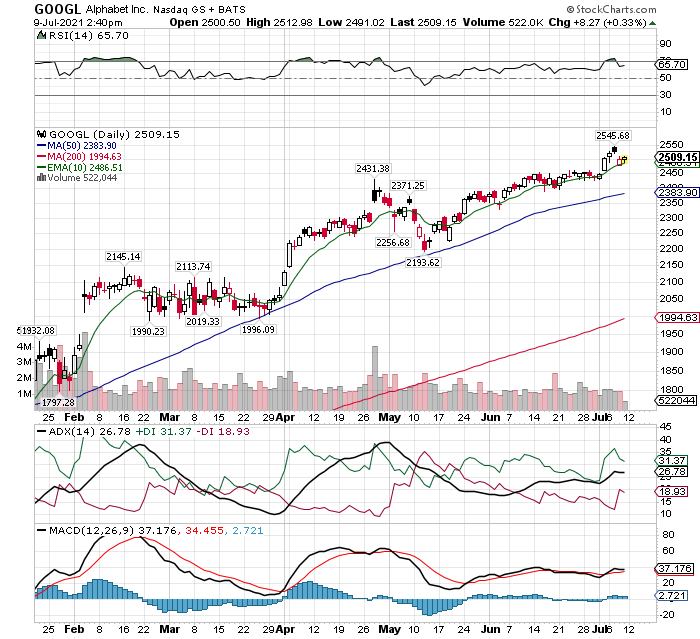

Alphabet Inc. (Nasdaq: GOOGL)

Google is the internet company you want to own. Google search and Youtube offer a quasi-monopolistic dominance over digital advertising. For sure, Facebook also plays an important role.

By all means, any pullback in price is an opportunity to buy Google.

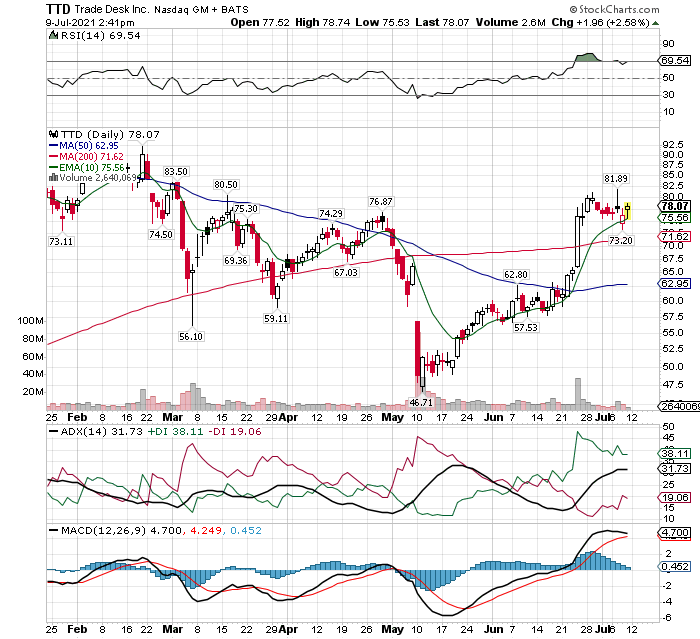

The Trade Desk Inc. (Nasdaq: TTD)

The Trade Desk is a stealth play on digital advertising. After all, The Trade Desk is the king of digital ads outside of social media. Not to mention this company is virtually unknown.

Recently the stock broke out to the upside after deep correction and a 10:1 stock split.

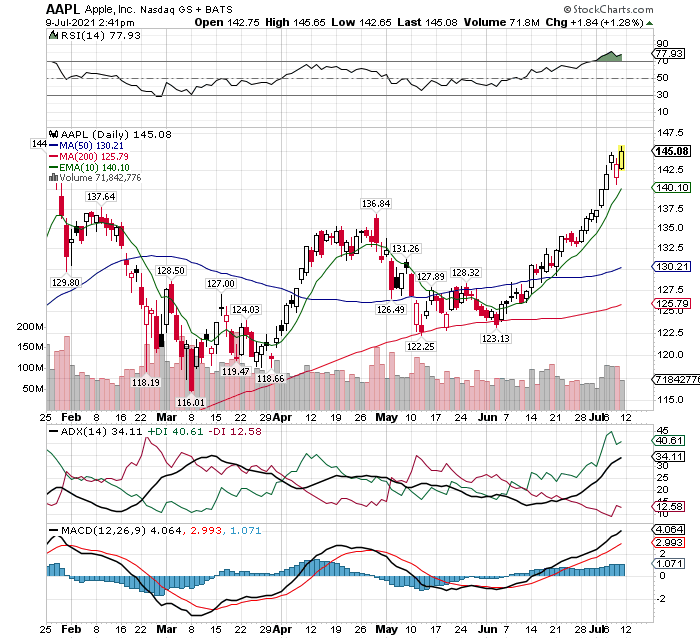

Apple Inc. (Nasdaq: AAPL)

If you want a trendy and popular device, chances are you own an Apple device. Furthermore, consumers brand loyalty is second to none.

Indeed, Apple’s cash hoard is an added bonus for long-term shareholders. By all means, pensions and institutional investors will continue to hold Apple shares as a core position.

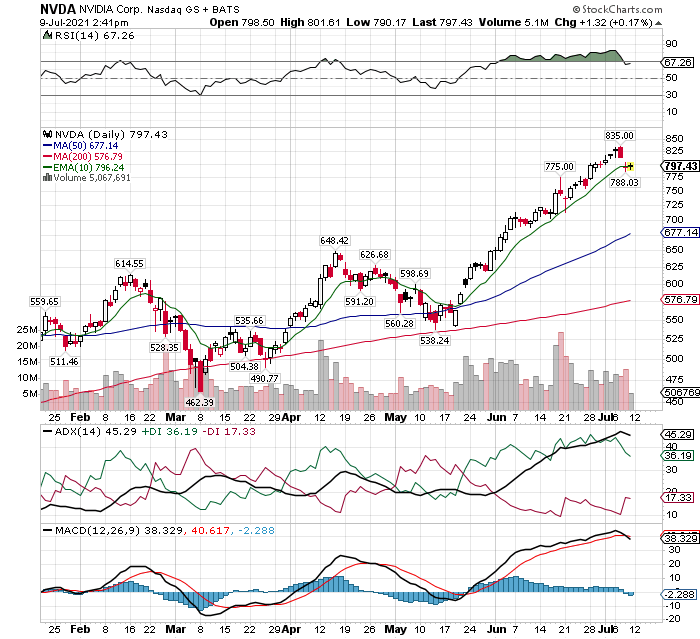

Nvidia Corp. (Nasdaq: NVDA)

Nvidia is the pioneer of gaming software and graphics. In addition, management has transformed the company into a sophisticated AI platform player. Nevertheless, the company’s venture into new computing models lead to the development of Electric vehicles (EV).

Surely, Nvidia’s partnerships with Volkswagen, Audi, Toyota, Hyundai, Volvo and Mercedes bold well for future earnings.

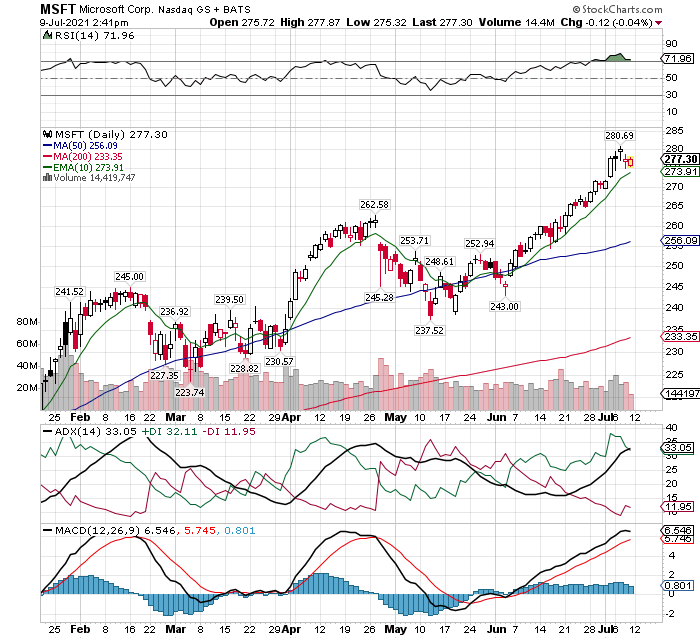

Microsoft Corp. (Nasdaq: MSFT)

Microsoft’s business plan is a winner. As a result, the stock is headed higher. Azure, Microsoft’s enterprise cloud-computing business is main source of earnings growth. By the same token, bundling with Office is a easy upsell to customers.

Certainly, conservative technology investors should take a close look at owning shares in Microsoft.

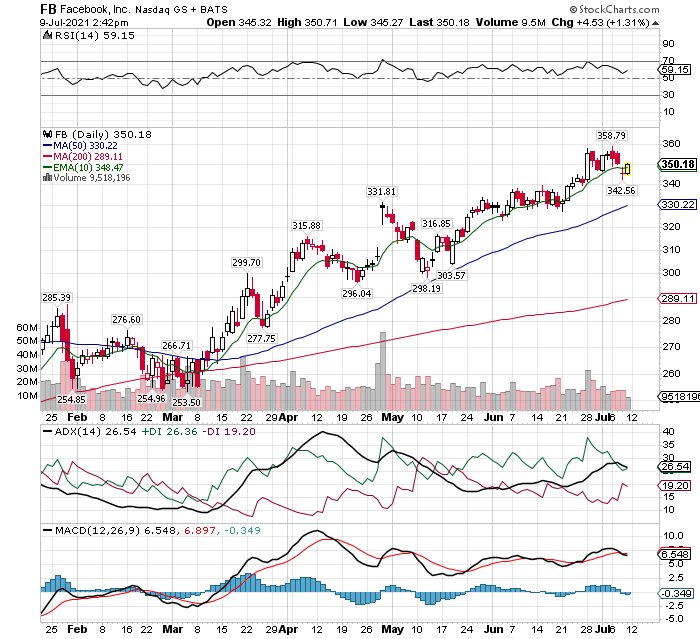

Facebook Inc. (Nasdaq: FB)

Facebook and Instagram offer incredible reach for digital advertisers. In the realm of social media, Facebook has the wider net to cast compared to its competitors.

Expect earnings to continue to beat Wall Street estimates. In that case, savvy investors will continue to buy the dips, which are few and far between.

Conclusion

Above all, technology investors have been rewarded handsomely since the Tech Bubble of 2000. The Information Age is coming of age and Wall Street is undervaluing what these companies are worth.

To sum it up, technology stocks are a strong buy on any price weakness.

Checkout my post on Apple’s recent breakout.

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved