Inflation and the bond market have puzzled investors since forever. Surely you’ve noticed the price of everything seems to be going up these days. But, is inflation taking root in our daily lives like the financial TV networks claim?

Without a doubt understanding inflation is important. More importantly, the difference between inflation and deflation is key. Obviously, those who understand this concept have an advantage.

Simply put, inflation is the increase in money supply. On the flip side, deflation is the decrease in money supply. Rising or falling prices are only symptoms.

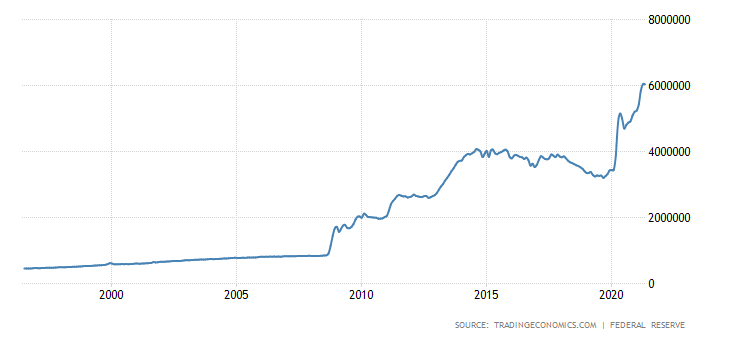

United States Money Supply – M0

One point often overlooked is that money is actually debt. So, the chart above indicates that debt (or the money supply) has been increasing at an alarming rate since the 2008 financial crisis. Of course the reverse is true, when debt is destroyed (or defaulted) you have deflation.

Fortunately, we have a tool at our disposal to signal whether inflation or deflation is the flavor of the day. Actually, this tool (or market) is used by professional traders to forecast inflation. Simple, right?

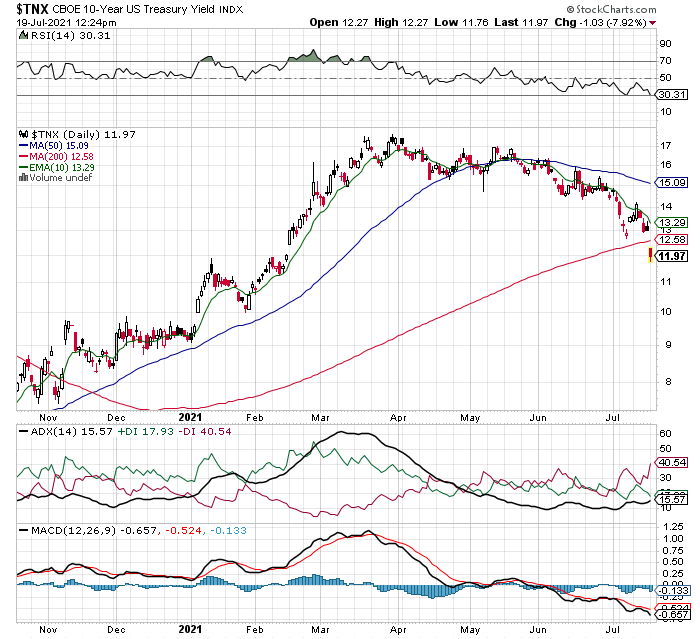

10 Year US Treasury Note – Bond Market

As you can see US treasury yields have been falling since April. This signals deflation is more dominant force than inflation, at least right now. To be fair, inflation started to gain traction to earlier this year. But, recent behavior of the bond market confirms inflation was only temporary.

Declining Bond Yields – What To Expect

- Federal Reserve Quantitative Easing Program is failing, or is not big enough.

- QE is not producing inflation as expected.

- Economy is weakening.

- Financial system needs more monetary stimulus to avoid a deflationary implosion.

Conclusion

The Federal Reserve will do everything in their power to produce inflation. Or avoid deflation for that matter even if it’s impossible to do so. In the end, the US dollar will continue to lose purchasing power. Unfortunately, this is bad news for main street and traditional savings vehicles.

Going forward, I’d expect the Federal Reserve to double down on Quantitative Easing. After all, the last thing the Fed wants is deflation. This means that US debt levels have the potential to rise to unimaginable levels.

What’s more, the Fed does not want to creditability with investors. Over time as investors realize the destruction of the US dollar, stocks will continue their historic bull run.

Now, be sure to check out the Ultimate Portfolio + page. Here you will find great stocks that are beating inflation big time!

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved