Should you buy the dip in stock prices?

Surely, if you follow this blog you know my opinion on stocks. And that is we’re in a stock bull market. The biggest stock bull market in history.

What’s truly incredible is we no longer get price corrections. Indeed, we do get small pull backs of 1% or so, but nothing like years past. I remember no too long ago when 10% corrections were the norm and we’d get a couple every year. But, not anymore.

However, if you were to turn on CNBC or Bloomberg you’d think the world was ending. I find it fascinating how many investor get rattled by sensational headlines. Do we forget the media lives by the notion, “if it bleeds it leads.”

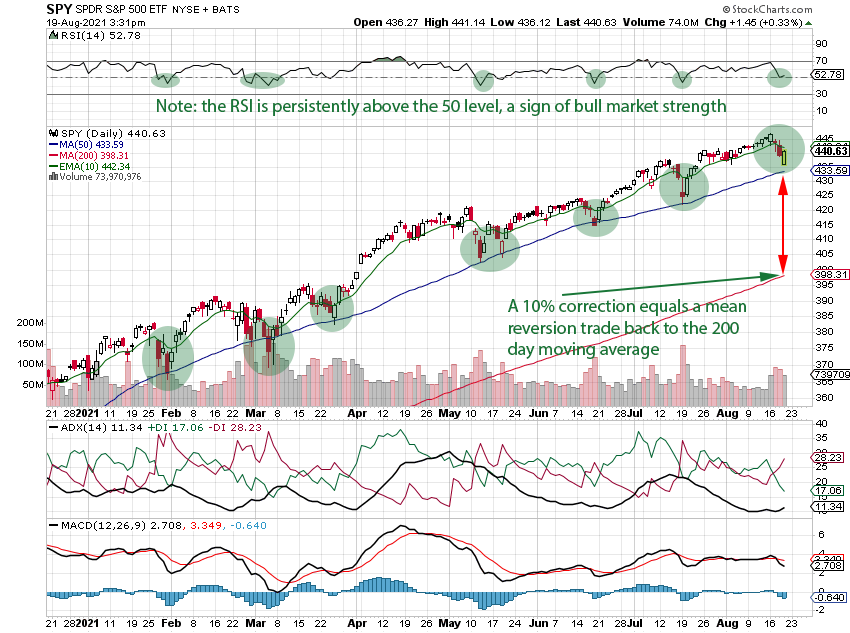

To be sure, there’s a lot of scared money out there getting rattled on a daily basis. But, if you were to look at the chart of the S&P 500 stock index ETF (SPY), you’d see a bullish chart. It’s that simple.

Technical Analysis Highlight: SPY

- RSI indicator persistently above 50, a sign of underlying strength

- mini corrections typically end at the 50 day moving average

- 10% drop to the 200 day moving average is possible

- ADX signaling a new trend (downside), but needs further confirmation

Yesterday the Federal Reserve minutes were released. Of course, everyone is in a fuss over tapering! What a surprise. Buy seriously, why does everyone forget what happened when the Fed started to taper back in December 2013? To recap, the market pulled back a little bit then took off to the races.

Point often overlooked is that any tapering will be slow and steady like last time. The Fed will not jerk the rug out from under the markets. Not a chance. Liquidity is here to stay.

Conclusion

The million dollar question is: should you buy the dip in stock prices?

By all means, if you were to follow the trend this year, now would be a good time to buy stocks. In this situation, there’s a chance of a 10% correction to the 200 day moving average. But the chances are pretty slim. We’d need some very negative news as a catalyst for a 10% correction.

Are you wondering if Bitcoin is going to sure higher? If so, I’ve got your Bitcoin charts right here.

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved