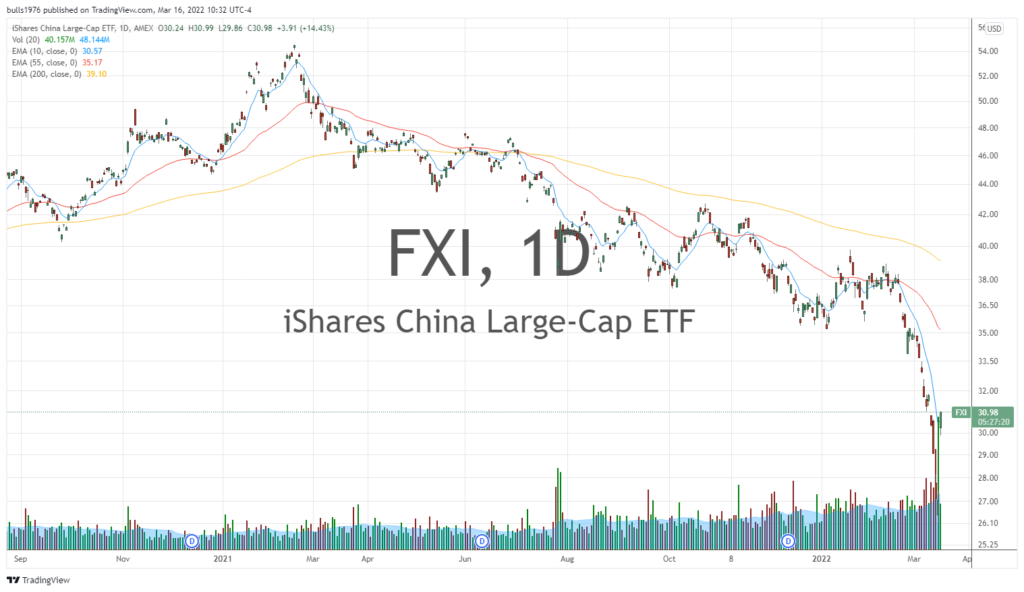

Investors have avoided investing in China since February 2021. Since that time, all Chinese equities declined massively. No sector was spared from the relentless selling. Below is a chart of FXI, an ETF representing China blue chip stocks, clearly illustrates the damage.

To be sure, multiple reasons discouraged investment in China and the entire region. Investors voted with their feet and transferred capital to US markets. Two key reasons explain the sell off:

- regulatory crackdown on Chinese technology companies,

- Evergrande liquidity crisis.

Together these events were very negative at the time. Indeed, regulatory changes are usually disruptive to the status quo. China is no exception. However, in this case, the sell off has turned into a buying opportunity.

The PBOC, or China’s central bank, started massive cash injections into their economy in December 2021. Of course, this response was a direct effort to shore up the real estate industry, specifically Evergrande. It is widely expected liquidity injections will continue as needed to keep growth chugging along.

Unquestionably, an opportunity is at hand to invest in Chinese real estate. Fortunately, Global X ETFs have the perfect vehicle for investors. It’s called the Global X MSCI China Real Estate ETF. This ETF carries a modest 0.66% management expense fee and spins off a 6.5% yield.

The stop-loss is well defined at $7.53, the March 15th low. The average daily trading range of the past 100 trading sessions is about $0.30. So, to avoid a frustrating whipsaw trade, you might want your stop to be around the $7.20 level. This way there is enough wiggle room to stick with the trade. The target take profit level is $10. In this case, I’m risking about $900 to make $2500. Not a bad risk/reward trade off.

Conclusion

In view of the current inflationary environment Chinese real estate makes a lot of sense to me for two reasons. First, a 6.5% yield certainly takes the sting out of the super high inflation rate. Second, from a contrarian point of view, no one is looking at Chinese real estate right now. This is top level sleeper trade.

Remember to mind your risk and trade your own view.

Portfolio Positions

DISCLAIMER: Content provided in this document is for your informational and entertainment purposes only. This document is not a solicitation for an investment, is not comprehensive, and should not for the basis for any investment decision. This document is not an offer to sell or a solicitation of an offer to buy any securities, commodities, or financial instruments, and my not be relied upon in connection with the purchase and sale of any instruments or interests in investment vehicles. This document should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this document.

Mikehoganonline (“MHO”) strongly suggests that you obtain independent advice in relation to any investment, and with respect to any financial, legal, tax, accounting or regulatory issues resulting form such an investment. In addition, because this document is only a high-level summary: it does not contain all materials terms pertinent to an investment decision. This document should not form the basis for any investment decision. Information contained in this document has been obtained from sources that MHO believes to be reliable, however MHO make no assurance or guarantee that such information is true and/or accurate, and MHO expressly disclaims liability arising form the use of information contained herein.

This document contains statements of opinion. These statements of opinion include, but are not limited to, MHO’s analysis and views with respect to: digital assets, projected inflation, macroeconomic policy, the market adoption of digital assets (including Bitcoin and Ethereum, and Blockchain), technical and fundamental analysis, financial planning, and the market in general. Statements of opinion herein have been formulated using MHO’s experience, research, and/or analysis, however, such statements also contain elements of subjectivity and are often subjective in nature. In addition, when conducting the analyses on which it bases statements of opinion, MHO has incorporated assumptions, which in some cases may prove to be inaccurate in the future, including in certain material aspects. These analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing in this documents represents a guarantee of any future outcome, or any representation or warranty as to future performance of any financial instruments, credit, currency rate, digital currency or other market or economic measure. Information provided reflects MHO’s views as of the date of this document and are subject to change without notice. MHO is under no obligation to update this document, notify any recipients, or re-publish the content contained herein in the event that nay factual assertions, assumptions, forward-looking statements, or opinions are subsequently shown to be inaccurate.

© 2022 mikehoganonline.com, All Rights Reserved