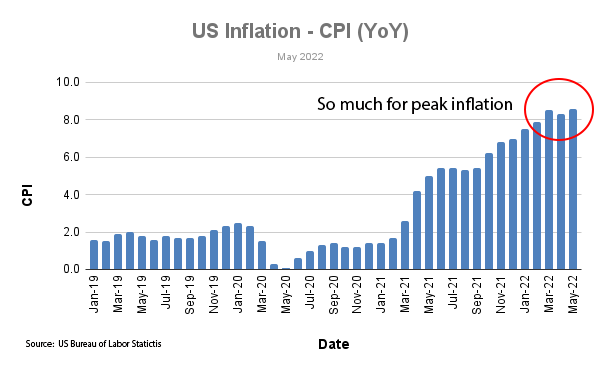

Core CPI snuffs peak inflation hopes, including mine. Last month I wrote about the possibility inflation had peaked, you can read that post here. Unfortunately, today’s monthly CPI data release by the US Bureau of Labor Statistics sets a new inflation record.

The inflation outlook is less than good. Stocks tank.

Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

What about peak inflation?

I was firmly in the “peak inflation” camp after April’s CPI number. Now, today’s CPI data torpedoes my thesis.

So, I’m back to square one with my inflation outlook. Going forward, I think it’s safe to assume inflation will remain high and consumers just have to get used to it.

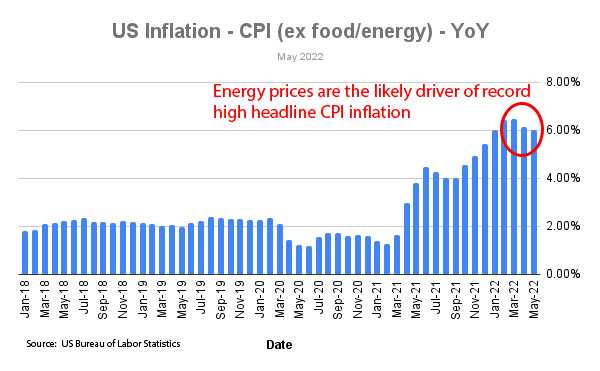

Adding to the discomfort, inflation is not peaking, nor is it cooling when looking at month-over-month data. Despite stripping out food and energy, we still have red hot inflation. Checkout the chart below.

CPI excluding food and energy has declined two months in a row. Clearly, energy and food prices are driving record headline inflation in the US.

Inventory builds up

Inventory build ups at Target and Walmart offers a glimmer of hope that retailers could slash prices to clear the glut. Unfortunately, this is the equivalent of popping a pimple. We need the Fed to crush inflation by hiking rates. But they’re moving at a snail pace. Relief for the consumer is a ways off.

Alpha Dog trade update

The Ensign Energy Services trade was stopped out today. No big deal. That’s part of trading. Regardless of the outcome, I still like oil drillers while oil is north of $120. I will look for an opportunity to re-enter this trade.

Sticking with tight risk parameters is the only way to avoid blowing up your trading account.

Looking back, perhaps I should have waited until after the CPI data release today. Don’t trade ahead of inflation data releases.

Overall, I’m a big believer in the energy sector bull market. It’s the one sector that’s in a solid uptrend.

Never fight the trend. Trend is your friend.

Conclusion

By all means, inflation is like a wildfire at the moment fueled by hurricane force winds. During times of stress and volatility, the best course of action is to reduce your level of risk. For short-term traders this can be accomplished by trading smaller positions sizes and sticking to risk parameters. Long-term investors could care less.

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.