(445 words, ~4 min read) Short one today as everything has quieted down since Powell spoke on Tuesday.

It’s never a bad idea to see how copper is trading. The metal is used to make just about everything. So, its behavior can help us assess risk in the market.

Dr. Copper sees a higher probability of a soft landing as its bullish trend remains in tack. However, price is off 7% from the recent high, so I think we’re in a equilibrium zone at the moment. A move higher would signal soft landing vibes and the opposite a mini recession.

Copper Chart

Now a quick look at other important markets

Commodities

The commodity complex is holding key support. I get the feeling it’s all about the price of oil going forward. If WTI can stay above $70 all is good in the hood. However, if prices slice/slide through that level the whole commodity complex will roll over and the mini recession odds go up.

See my post earlier this week titled Economic Outcomes to see the odds assigned to each path the economy could take this year. The likely paths are either soft landing or mini recession.

Russia’s spring military offensive will likely push oil higher. I don’t believe this event is priced in yet.

China reopening

Chinese equities hit a wall on January 30th and seem to be suffering from a multi-day hangover. So far not much technical damage shows up on the charts. It looks like a bullish pullback, but we need to see some strength soon, otherwise short-term spec longs will bail.

Further weakness in Chinese equites also mean soft landing odds fall.

Final Thoughts

In the end, all the global macro economic signals are mixed or indecisive. From commodities to the China reopening story, markets seem to be drifting alone, listless (HT Pearl Jam).

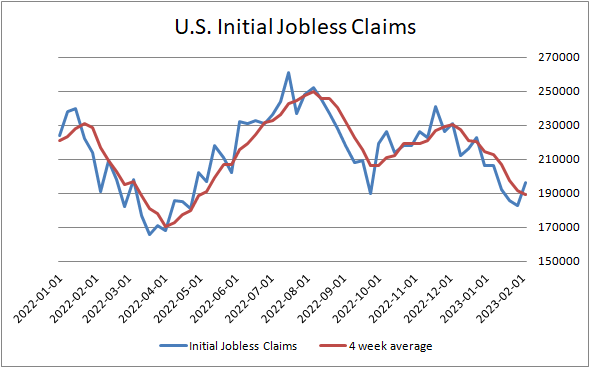

Today’s initial jobless claims did nothing to change the labor market outlook. Historic tightness continues as employers hold on to workers and those who unfortunately get laid off find a new job right away. Until initial claims show a hint of rising the unemployment rate won’t budge.

No changes to the asset allocation of our flagship ETF portfolio. Staying defensive for now.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, checkout this post.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.