(690 words – 6 minute read)

This is my weekly update on the state of the economy and the ETF portfolio asset allocation models.

Key economic stats

- US 30year mortgage rate 6.62%, that’s pretty high and should not help demand much

- US mortgage applications plunged 13.3%

- US pending home sales rose 8.1% during January (+7% MoM), wut? This conflicts with bullet one and two

- January durable goods orders fell 4.5%

- core PCE price index (Fed’s preferred measure of inflation) rose to 0.6% MoM, higher than expected

- weekly US initial jobless claim fell to ~192k, signaling the labor market is still strong

- US 5yr real yields rally to 1.72%, financial conditions tightened during February

Statistically speaking, there’s no clear signal here as the data is either good or bad. For example, surging mortgage rates lead to a monster +8.1% rise in existing US home sales during January. Go figure.

As I’ve said in the past, as long as people have a job they can pay their mortgage and credit card minimums all is good, but no job equals economic disaster.

Other observations

- markets have been orderly (low VIX)

- US 10yr yields are behaving and not acting super scary (low MOVE index)

- Yield curve inversion persists (100% recession hit rate, hard to ignore)

Markets seem to be adjusting to a higher terminal rate, somewhere north of 5%. Orderly markets are bullish in general, so this is a good thing, for now.

As an aside, a subprime auto lender in the US shut down last week, maybe a butterfly flapped its wings in Brazil, or it’s nothing as the size of this market is only $20 billion.

Regardless, there is no fear in the market right now.

Now let’s take a quick look at the portfolios: 1) the Alpha portfolio and 2) the classic Passive 60/40 portfolio.

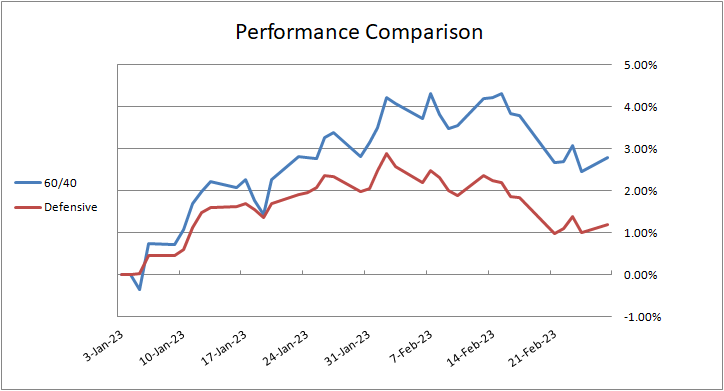

Defensive ETF Portfolio versus the classic 60/40 portfolio

as of January 24, 2023

February has come to a close and the Alpha portfolio has underperformed the Passive 60/40 portfolio so far. With t-bills yielding better than 5% you get paid to wait for opportunities. More to come later on the opportunities.

No FOMO.

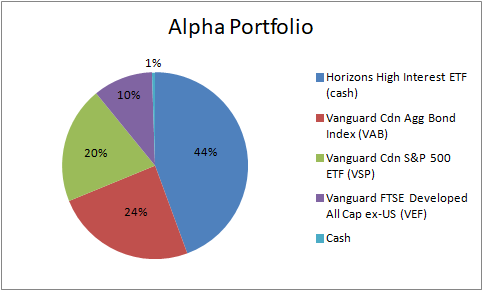

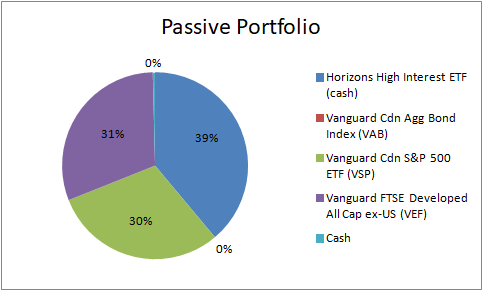

Asset Allocations

as of February 28, 2023

Final thoughts

The forecast this year is fog and overcast skies with no clear direction for the economy. That pretty much sums it up.

Even though the macro economic data is lousy at the moment, I still prefer the cautious approach for now.

Remember that financial conditions have tightened since the start of the year. Loose financial conditions drive risk assets higher, not the other way around.

Regardless, the next major data releases are NFP on 08MAR and CPI on 14MAR.

To be sure, recent data releases like retail sales, PMIs and housing all look better, but that’s due to the modest easing of financial conditions since November. See chart below of US 5yr real yields.

When financial conditions loosen like this we often see an improvement in macro economic data 1-2 months later. But, February saw a material tightening in financial conditions in response to sticky January inflation PMIs.

In the final analysis, we need more clarity around the possible economic outcomes before adding additional risk to he portfolio. At this point, the expected returns are not worth the risk, in my opinion. Besides, when was the last time you pickup >5% yield on 1 month t-bills?

This is the time to sit on your hands and wait for an opportunity. Paid to wait.

No changes to the asset allocation of our flagship ETF portfolio. Staying defensive for now,.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, if you don’t already have one.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.