The 2020 US election results are trickling in. There is no clear winner at the moment. Yet, Both Trump and Biden have claimed victory.

President Trump claims he has won and will go all the way to the US supreme court to cement his victory. With this in mind, it’s expected a delayed result would be terrible for stocks. At least that’s what market experts were claiming leading up to the 2020 US election.

But, the market ripped higher at the open this morning. It appears the stock market could care less who wins the election.

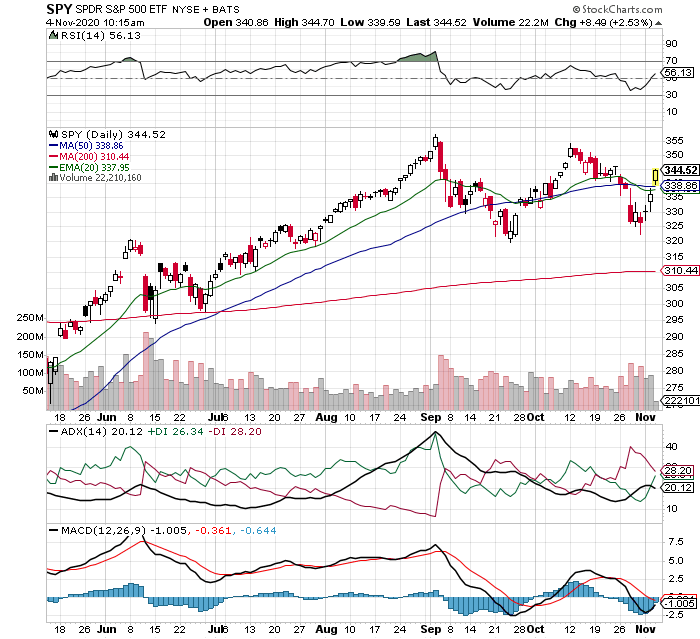

The chart below illustrates how stocks retreated into election day. But, since Monday stocks have been on a tear. Investor’s sitting in cash on the sidelines must be pulling their hair out.

Stocks could be setting up a downside reversal? After all, how could stock prices rise in an environment of uncertainty?

To confirm the direction of stock prices we need to see how the market closes today. A strong close could signal a new rally is underway. A weak close would signal more uncertainty ahead. Also, how the market opens tomorrow is important as well.

It’s way too early to determine the direction of stock prices.

Equally important, a disciplined investor should have a model portfolio asset allocation. A well designed asset allocation can take advantage of situations shrouded in uncertainty.

Conclusion

On a final note, several sectors are not participating in today’s rally. For example, precious metals and commodity stocks are trading lower. More importantly, the financial sector is not participating in today’s rally.

In the final analysis, hot money is jamming into technology stocks. As a result, stock indexes are vaulting higher. Under the surface, dividend stocks and financials are lagging and commodities are falling. Not exactly the recipe for a broad based stock market rally.

This suggests a stock market held up by big technology stocks. Names like Amazon, Microsoft, Nvidia, Alphabet, Netflix, and Apple should ring a bell.