April US producer price index falls providing a glimmer of hope the worst inflation is behind us. I’m really stretching here to find a positive outlook on inflation.

Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

What is the Producer Price Index?

Simply put, the PPI is an index that calculates the average movement of selling prices for domestic production. In other words, it calculates inflation from the viewpoint of industries that make products. Bottom line, its a measure of inflation based on input costs to producers.

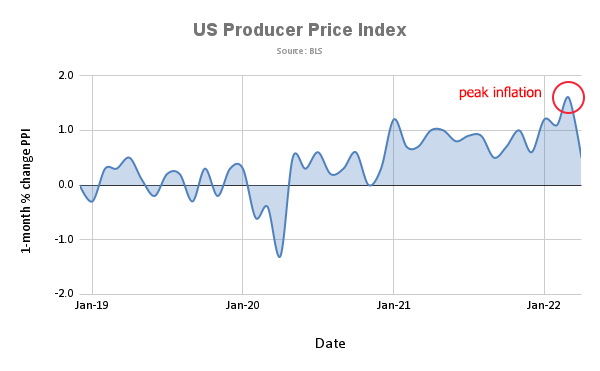

Take a look at the chart below. Just like yesterday’s post on CPI, there’s an obvious “top” in the data series. In either case, we’re talking about one data point (April) where inflation cooled, somewhat. While this may be true, it’s not a reason to get all bulled up on the market. But, it could be peak inflation, although prices could stay elevated for longer than expected.

Conclusion

By and large inflation is a real problem right now. Leading causes of inflation include:

- Low short-term interest rates (too loose too long)

- War in Ukraine

- Supply chain disruptions

- China’s zero C-19 policy (aka. Shanghai shutdown)

Regardless, I’m looking for one final toilet flush, or a crazy in your face short covering rally. Until then, I’m happy to sit on the sidelines and watch the show. I’ve tried to catch a falling knife too many times and know that is usually hurts. So, I’m making every attempt to keep my emotions in check. So should you.

Be flexible. Trade your own ideas. Love everyone. Call you mom.

Alpha Dawg – daily notes on investing and trading for self-directed investors and traders looking to execute trading ideas and manage risk.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.