Today I thought I’d provide an update on the performance of the Alpha/Active portfolio compared to the passive portfolio.

To recap, I run two portfolios simultaneously. One is an Alpha portfolio where I try to beat a benchmark passive 60/40 portfolio.

For those of you who are new to investing, an Alpha or active investment strategy tries to outperform a passive benchmark portfolio of similar characteristics.

In this case, the passive benchmark portfolio is the classic 60/40 portfolio where 60% is allocated to equities and the remaining 40% to fixed income.

On the other hand, the Alpha or active portfolio attempts to adjust the asset allocation based on macro economic data and prevailing market narratives, with the goal of outperforming the passive portfolio.

The majority of portfolios owned by retail investors follow the Alpha or active investment strategy.

A major challenge facing Alpha/active management strategies are high fees incurred to research, design, and operate the portfolio. There is a long running debate about which strategy is better: Alpha/active or passive. Here is a great article by Morgan Stanley that explores this debate further.

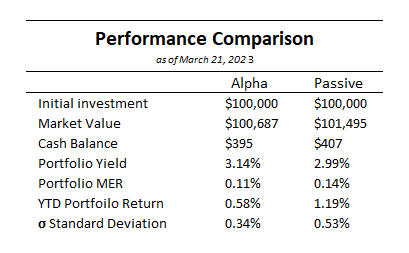

Active versus Passive Strategies – as of March 20, 2023

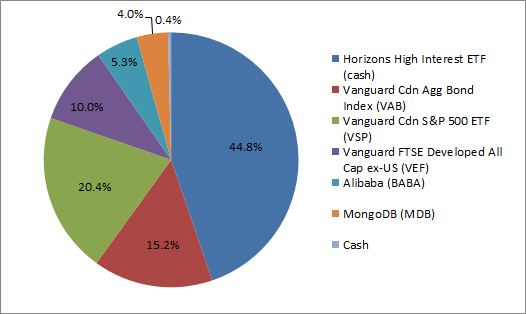

Asset Allocation – Alpha/Active

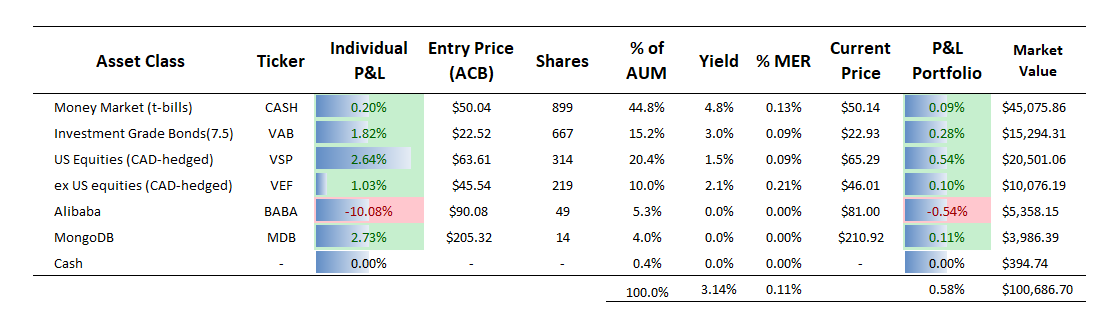

Portfolio Holdings – Alpha/Active

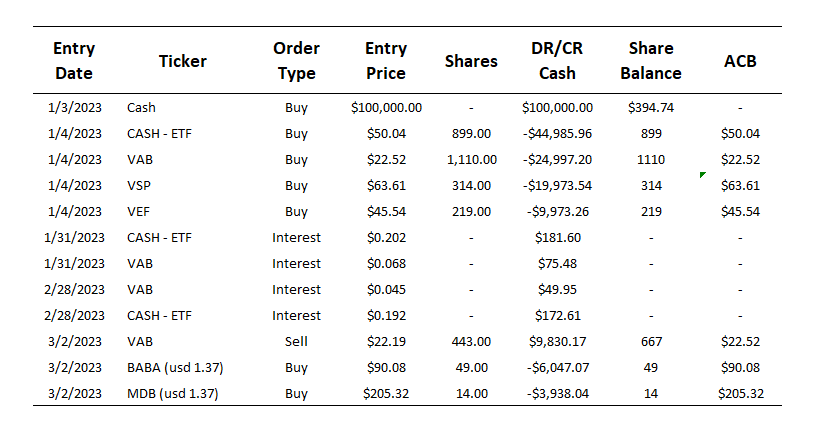

Transactions – Alpha/Active

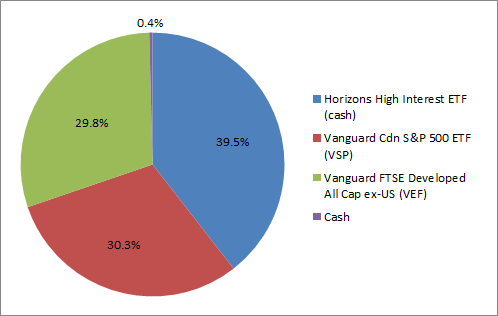

Asset Allocation – 60/40 Passive

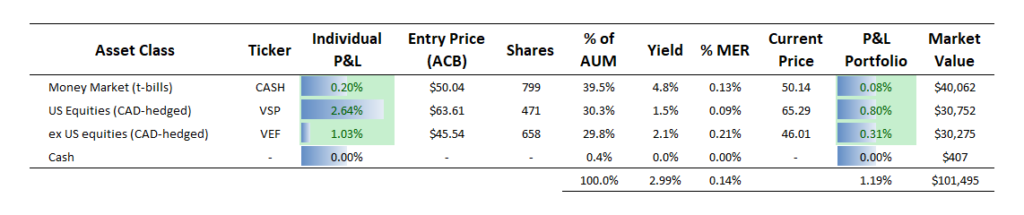

Portfolio Holdings – 60/40 Passive

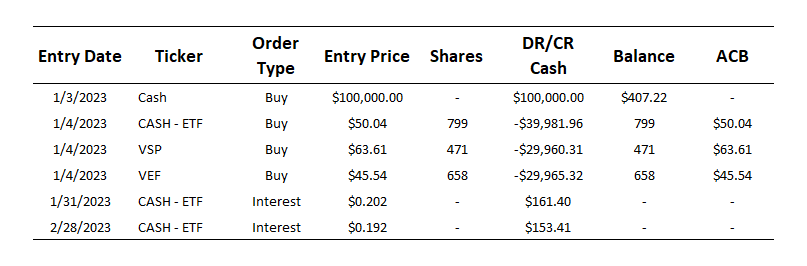

Transactions – 60/40 Passive

Alpha/Active versus Passive Scorecard

Final Thoughts

Over the past year risk assets faced an uphill battle due to high inflation, rising interest rates, and now a banking crisis in the US and Europe. Market participants discounted risk assets last year in response to higher short-term borrowing costs, but have future corporate earnings been discounted for a recession? That’s the big question.

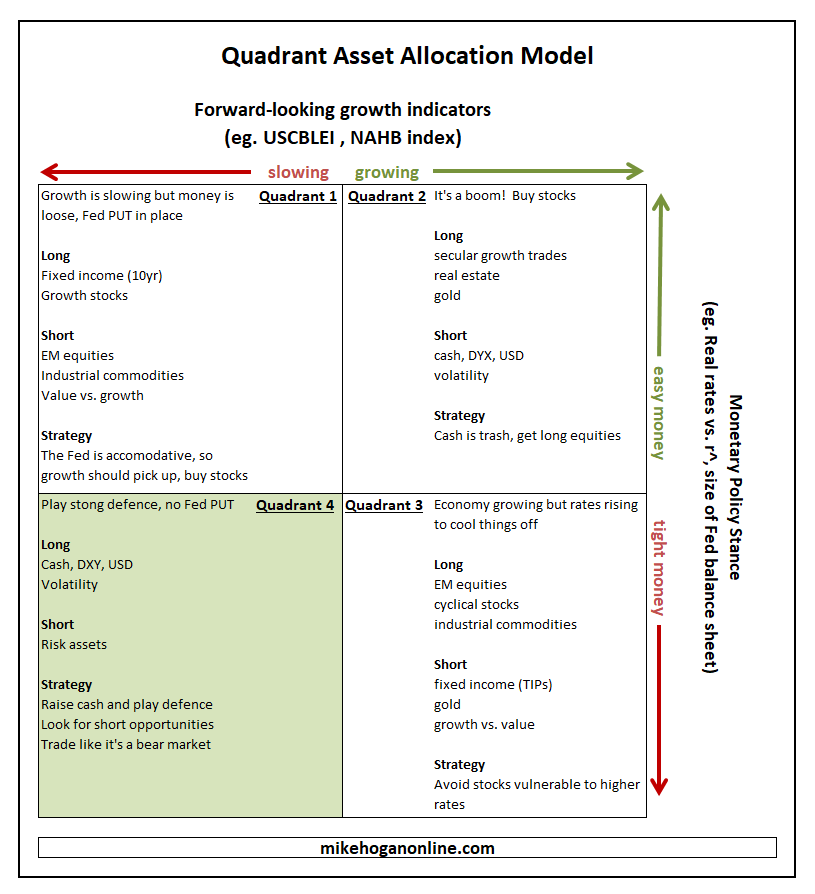

In my opinion, based on my Quadrant Asset Allocation Model we remain stuck in Quadrant 4. Quadrant 4 is a macro investing environment where growth and monetary policy act like headwinds indicating prevailing risk levels are high. In this environment it’s best to remain defensive until economic conditions change.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, if you don’t already have one.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.