Calm before the storm as seasonal weakness and US mid-term elections put a lid on risk asset upside.

This is a way of saying risk to the downside is meaningful right now, but opportunities are plenty.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

Economic calendar

The economic calendar is jam-packed heading into the fall. Below I’ve listed the important dates. This list covers mainly inflation and interest rates, key drivers of risk assets.

Key data release dates (US data only):

- Sept 13th – CPI

- Sept 14th – PPI

- Sept 16th – UofM sentiment

- Sept 21st – FED interest rate decision

- Sept 30th – Core PCE

- Oct 12th – PPI

- Oct 13th – CPI

- Oct 14th – UofM sentiment

- Nov 1st & 2nd – FED interest rate decision

- Nov 8th – US mid-term elections

- Dec 13th-14th – FED interest rate decision

Leading indicators

Last week I wrote a post about economic leading indicators. You can find it here. Bottom line, leading indicators are pointing towards a slowing US economy, which makes sense given super high inflation and rising interest rates. However, what’s important is paying attention for a turn in housing and sentiment. No dice yet.

Market Narrative

Understanding market narratives is key to investing successfully. More importantly, spotting changes in narrative is a skill learned overtime and mastered by pros.

The dominant narrative at the moment is higher rates ahead to kill inflation. Not good for risk assets. Prior to Jackson Hole investors believed the inflation fight was coming to an end and interest rates cuts were around the corner. Well, Powell killed that idea with his crystal clear message at Jackson Hole that putting the inflation genie back in the bottle is priority number one.

As a result, the bullish FED pivot narrative which drove the risk asset rally from mid-June to the end of August has taken a back seat. Maybe this dovish narrative can elbow its way back into the psyche of investors, but for now it’s a no go. Bullish vibes will have to wait.

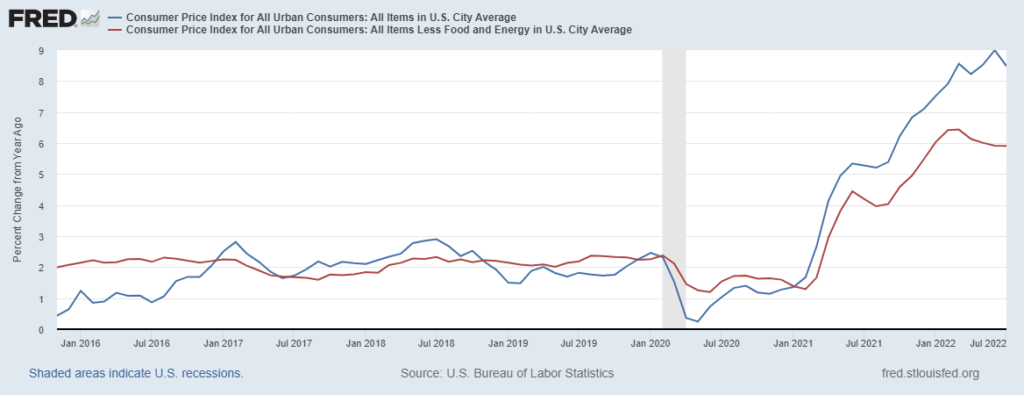

Inflation

Everything is about inflation right now. How quickly will it come down? What about wage inflation? Nobody can afford anything, it’s too expensive!

Certainly, I’ve never experienced inflation like this in my lifetime. So, the need to trade big positions is foolish, a little risk can go a long way. Well thought out trades with tight risk management is an optimal strategy.

The bullish narrative needs to see a rapid drop in inflation/CPI back to the 2% level. Anything short of that means the “higher rates to kill inflation” narrative will dominate markets. Until then, risk assets will have a tough time.

U.S. Inflation (CPI)

Trade Update

The DVN trade from August 11th was stopped out on August 31st at $69.95 booking a 8.5% gain. Coupled with the SPY trade (-3.2% loss) the pair trade resulted in a net +5.3% return over 15 days.

No new trades to post today. Flat for now.

Conclusion

Heading into the fall global markets will likely see increased volatility due to seasonal patterns like the typical ugly September for stocks and weakness into mid-term elections. This might serve up some decent opportunities to pick up equites are optimal prices. Volatility leads to opportunities.

In the end, there is little reason to get all bullish on stocks right now. Wait for a better opportunity.

Calm before the storm as seasonal weakness and US mid-term elections put a lid on risk asset upside.

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.