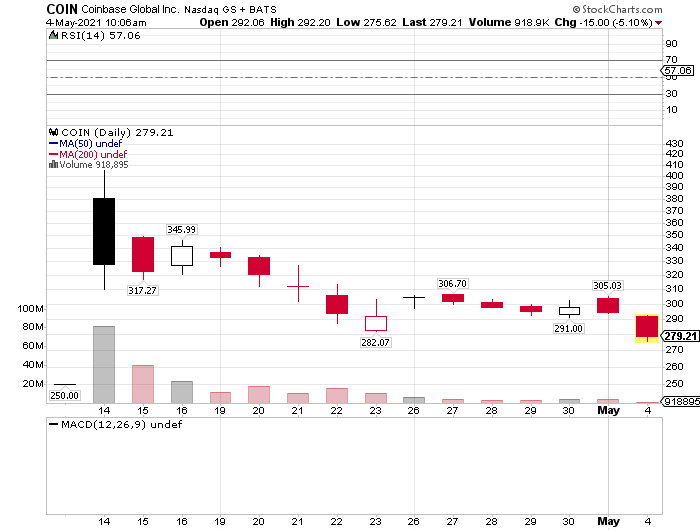

Coinbase stock (COIN – nasdaq) went public on April 14th at $250 per share. To little surprise, the price surged to $430 on its first day trading. Since then, it’s been a downhill slide.

Savvy investors should seriously consider using the current weakness as a buying opportunity.

Why? Well, Coinbase stock is the first crypto exchange to go public and their business model is best of breed.

For example, Coinbase racked up $1.14 billion in sales during 2020, an increase of 139% year over year. That’s the type of growth Wall Street drools over.

Coinbase is a misunderstood, but very profitable business. We’re talking about a thousand percent growth rate.

Coinbase stock is currently trading at its lowest price since its direct listing. To be sure, price is in a downtrend, but buying weakness has always been a solid long term trading strategy.

Conclusion

Not if but when, Bitcoin finally gets the respect it deserves, the price of Coinbase stock could be much higher than current valuations. Seriously, if Elon Musk, founder of Tesla, will accept Bitcoin as payment, it’s only a matter of time before everyone else falls in line.

On the other hand, new businesses and technologies take time to become mainstream. In any case, being first to the party is a recipe for profits.

Be sure to check out the Ultimate Portfolio + page. Here you will find all the great companies that are making investors big money.

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved