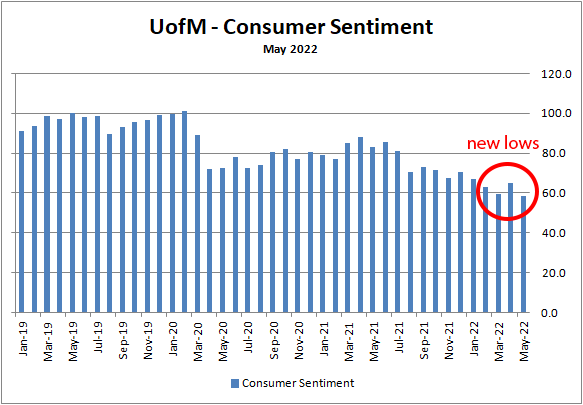

Consumer sentiment stinks as the University of Michigan’s consumer sentiment survey hit a new cycle low on Friday.

This data point flew under the radar as investors were hyper-focused on the headline CPI number. Which was a bell ringer to say the least.

Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

Consumer Sentiment

The chart below highlights the fact consumer sentiment is at a record low. Not good. A recession looks plausible at this point in the cycle.

No doubt, it’s becoming harder to argue against an economic slow down with the recent data points:

- record high inflation

- uptick in initial jobless claims

- record high gasoline prices

Down the road at some point demand destruction will likely be achieved and economic activity will fall off a cliff.

For now, volatility will only increase until the Fed regains its credibility. Surely, this week the Fed has an opportunity to move aggressively with a 75bps rate hike. I think we’ll get 50bps. Either way, it’s too little too late. Credibility is kaput.

The question is whether the Fed will have lifted rates high enough to be able to soften the blow with meaningful rate cuts when the next recession hits?

Risk Matters

On Friday Alpha Dawg’s recent trade was blown out of the water. After careful analysis I thought the trade had reasonable prospects of being a winner. Oh boy, was I wrong.

Had I not added rigorous risk rules to the trade, like a stop loss, I’d be down over 15% in three days. Ouch! By pre-determining and automating my stop-loss, I was able to exit the trade with a 1% loss.

Fortunately, I’ve been around long enough to realize I’m wrong sometimes. That’s part of investing and trading. Not every idea turns out to be a winner.

For the most part, I always automate my stop loss orders and so should you. Human bias certainly will try talk you out of your stop loss once the trade is live. Once money is on the table chances are your objectivity is suspect.

Luckily in this case, I kept my lizard brain in check.

The good news, sound risk management always matters. Never disregard risk of ruin.

Conclusion

Consumer sentiment stinks and the global economic situation keeps deteriorating.

For short-term traders, those with discipline and sound risk management, opportunities are plentiful to play from both the long and short side. As always, during times of volatility, trading smaller size goes a long way. Don’t forget that.

Long-term investors should maintain their asset allocations and look to deploy cash reserves when conditions offer an attractive opportunity. Otherwise, who cares about short-term chaos and volatility.

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.