As COVID-19 cases surge in the developed world, stock markets continue to rise.

Not surprisingly, financial TV is spinning the worry wheel again. That’s what mainstream media does. After all, the old saying goes, “If it bleeds it leads.”

So, if you are looking for solid information about COVID-19 check out the world sick map. It’s a good place to start. And it’s not spun by mainstream media.

Unfortunately, investors who follow CNBC, MSNBC or BNN – are being fed “news” to keep you out of the market. Seriously, listen to the headlines for a minute and you’d think the world was coming to an end. As a result, investors who are not “in” the market are being left behind.

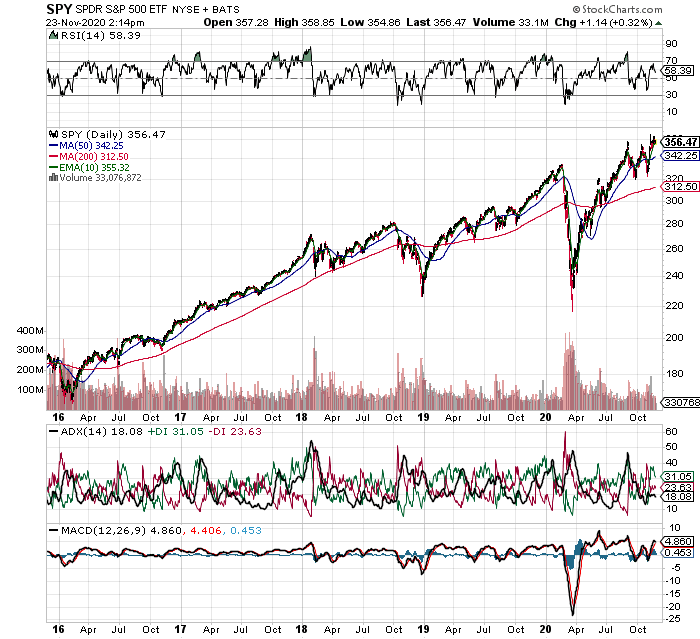

Below is a 5 year chart of the S&P 500 stock index. Stocks are at an all time high!

Recently I wrote about how Stocks Staged Bullish Breakout just after the US election. But, most investors can’t seem to invest their cash. They feel it’s too risky! Unfortunately, cash is the worst investment out there. And bonds aren’t much better. Even high quality corporate bonds are a loser, I’ll explain below.

Negative Real Return and Inflation

What is a negative real return?

And what is inflation?

In fact, understanding how to figure out your real return is very important. But, very few investors grasp the idea.

For example, if cash pays 0% and inflation is 2% – you lose 2% on your investment.

As of November 20, 2020, the effective corporate AAA bond yield was 1.55%. Again, AAA corporate bonds yield a negative real return of 0.45%.

Investors be aware!

Conclusion

In the end, even as COVID-19 cases surge, and the world is in shambles according to mainstream media, stocks are in a bull market.

So, don’t be caught on the sidelines holding cash. Or worse yet, bonds! Unfortunately, both of these investments are a guaranteed loss. Obviously, there is a reason stocks keep going up. All things considered, cash is pouring into stocks. Why? Nobody wants a guaranteed loss like cash and bonds offer.