(418 words – ~ 4 minute read)

This is my weekly update on the state of the markets and any changes to the asset allocation models.

2023 Economic Outcome Probabilities

| Outcome | Description | Feb 22 | Feb 13 | Feb 8 | Feb 1 | Jan 1 |

|---|---|---|---|---|---|---|

| No landing | Inflation stays high, growth is meh, employment stays strong | 15% | 10% | 10% | 15% | 5% |

| Soft landing | Inflation slowly returns to 2%, growth slows, employment says strong | 35% | 40% | 40% | 40% | 40% |

| Mini recession | Inflation returns to 2%, growth slows, unemployment rate modestly rises | 40% | 40% | 40% | 35% | 40% |

| Hard landing | Inflation drops to 2%, growth materially slows, unemployment jumps higher | 10% | 10% | 10% | 10% | 10% |

| Crash landing | Inflation and growth collapse, unemployment surges | 5% | 5% | 5% | 5% | 5% |

No change in probabilities from last week. You can find last week’s update here if interested. The major change this year was the increased likelihood of a “no landing scenario”. Under this outcome inflation would stay high and infuriate the Fed while growth stays positive and employment strong. This outcome is largely driven by the Chinese reopening narrative which took hold Q4 2022. Note that Chinese equities are acting weak in February.

The meat of the distribution is between soft landing and mini-recession. The fulcrum of this setup is the employment picture. If people have jobs they can pay their mortgage and credit card minimums. This months employment data out of Canada and the US are read hot, so it’s slowly tilting the odds towards soft-landing.

To be sure, the labor market is all that matters right now.

This week is packed with economic data:

- Feb 14th – US CPI (inflation)

- Feb 15th – Retail sales, NAHB index

- Feb 16th – PPI, Housing starts, continuing jobless claims

- Feb 17th – CB leading index

I expect inflation not to moderate significantly in January. Recently there have been upward revisions to the inflation data. That said, I don’t expect big miss either to the downside or upside, but expect big volatility around the release of the inflation data.

Next week could see major revisions to the economic outcome probabilities.

Now it’s time to take a look at the the flagship ETF portfolio in detail.

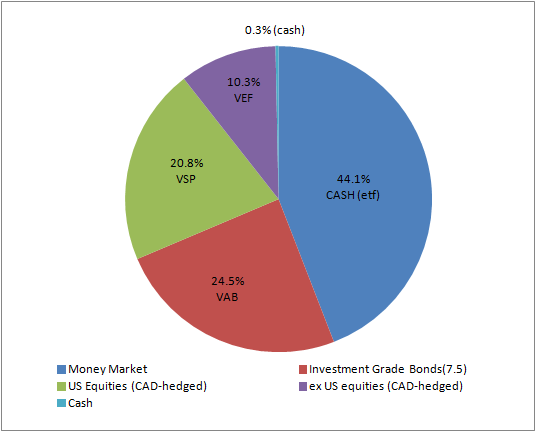

Flagship ETF Asset Allocation

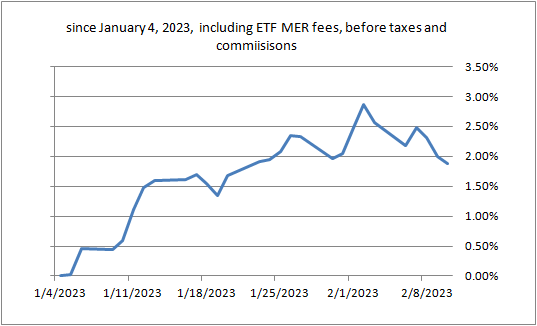

Flagship ETF YTD Performance

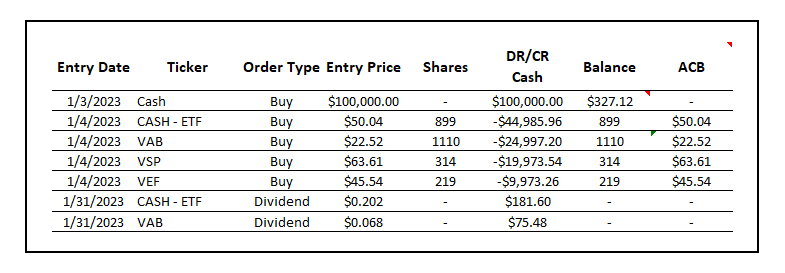

Flagship ETF Portfolio Transactions

Final Thoughts

In the final analysis, we need more clarity around the possible economic outcomes before adding additional risk tot he portfolio. At this point, the expected returns are worth the risk, in my opinion.

Sometimes, actually most of the time, the hardest thing for an investor to do is nothing.

No changes to the asset allocation of our flagship ETF portfolio. Staying defensive for now, and keeping a close eye on a few opportunities.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, if you don’t already have one.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.