(514 words ~ 5 minute read)

This is my weekly update on the state of the economy and the ETF portfolio asset allocation models.

Philip Tetlock wrote in his book Super Forecasting the following, “We have all been too quick to make up our minds and too slow to change them.” If you haven’t read Super Forecasting I highly recommend it. The author calls out the complete lack of accountability when it comes to financial forecasts. Very rarely, if ever, are Financial TV pundits or experts held accountable to the many hundreds of forecasts spewed across the airwaves everyday.

I agree. That’s why I started to publish my own probabilities updated with new information on a timely basis. This way, I can stay in tune with what the data and markets are telling us. Below are my 2023 economic outcomes and assigned probabilities.

This process is outlined in Super Forecasting, I highly recommend reading it!

This past week revealed the following new information which may or may not change the probabilities:

- China reopening narrative stalls (China FXI etf trending lower)

- Real and nominal yields moving higher

- Bond volatility rising

- DBC commodity index tacking lower and looking heavy

- Dr. Copper looking strong (what’s up with the DBC commodity index then?)

- monthly PPI data casts doubt on the ongoing disinflationary trend

As a result of taking this new information into account, the soft landing outcome warrants a reduced probability. Higher bond volatility and the PPI shock from last week are key variables to keep an eye on going forward.

2023 Economic Outcome Probabilities

| Outcome | Description | Feb 22 | Feb 13 | Feb 8 | Feb 1 | Jan 1 |

|---|---|---|---|---|---|---|

| No landing | Inflation stays high, growth is meh, employment stays strong | 15% | 10% | 10% | 15% | 5% |

| Soft landing | Inflation slowly returns to 2%, growth slows, employment says strong | 35% | 40% | 40% | 40% | 40% |

| Mini recession | Inflation returns to 2%, growth slows, unemployment rate modestly rises | 40% | 40% | 40% | 35% | 40% |

| Hard landing | Inflation drops to 2%, growth materially slows, unemployment jumps higher | 10% | 10% | 10% | 10% | 10% |

| Crash landing | Inflation and growth collapse, unemployment surges | 5% | 5% | 5% | 5% | 5% |

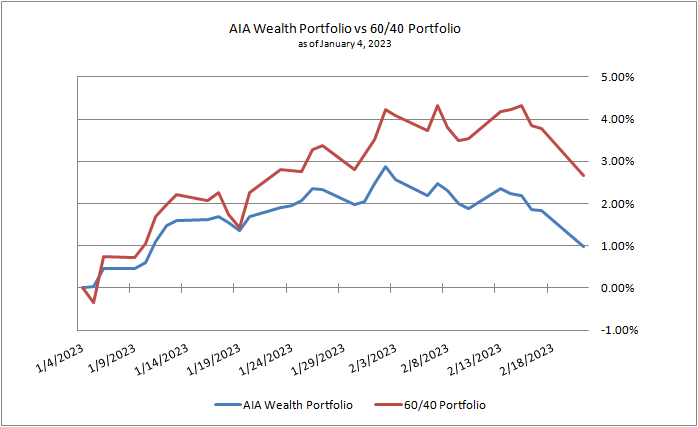

ETF Portfolio Performance YTD

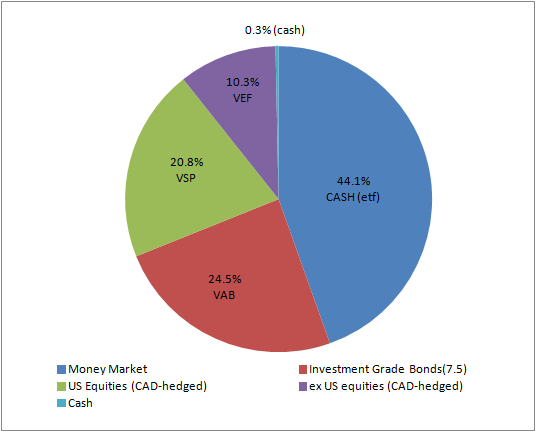

No changes to the ETF portfolio this week. A defensive asset allocation is warranted as the economic outcomes teeter between a soft landing and a mini-recession. Until we get a clearer indication where the economy is headed, taking on addition risk seems pointless to me. In addition, my flagship Quadrant Asset Allocation Model has yet to turn bullish. So, we still need a hat and mittens to stay warm.

Year-to-date the AIA Wealth ETF Portfolio is underperforming the classic 60/40 ETF portfolio. Clearly, the massive January rally is risk assets accounted for the difference.

ETF Portfolio Asset Allocation

Final Thoughts

In the final analysis, we need more clarity around the possible economic outcomes before adding additional risk to he portfolio. At this point, the expected returns are not worth the risk, in my opinion.

An investor always has the choice to do nothing, sit on their hands, but most fail to have this level of self control.

No changes to the asset allocation of our flagship ETF portfolio. Staying defensive for now, and keeping a close eye on the economic data and for any opportunities.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, if you don’t already have one.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.