Fed hikes rates by 75pbs and a red hot PPI read signals there is more paid to come short-term.

Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

Does the Fed have any credibility left?

Yesterday Powell desperately tried to reassure markets that stomping out inflation is job number one.

Unfortunately for consumers this is bad news. To be sure, future income will shrink thanks to higher interest payments. This means less stuff being bought and further inventory builds at retailers.

Certainly, the University of Michigan sentiment survey, one of my favorite data series, will likely deteriorate further. I wrote about the UoM survey here. Poor survey results usually signal bad times for risk assets.

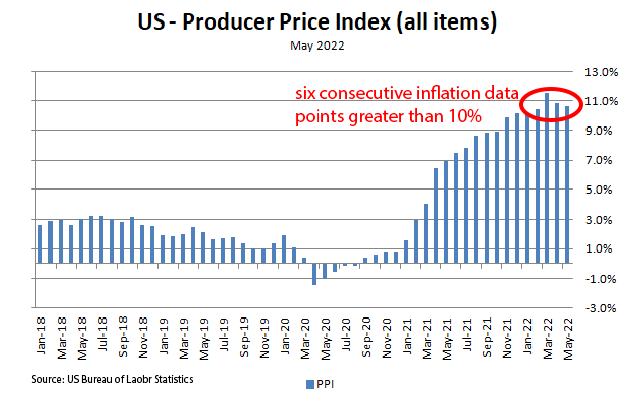

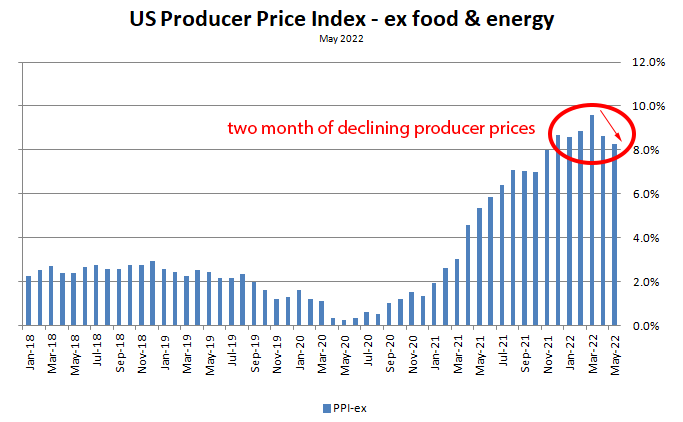

US producer price index

On Wednesday the BLS updated their PPI data series. Not much surprise here. Inflation is still red hot.

Without a doubt, the ECB emergency meeting and the Fed’s 75bps hike is nothing less than a desperate attempt to regain credibility.

On the positive side, policy makers are finally taking inflation seriously. Despite this, a tight road lies ahead for consumers.

Next moves

All things considered, risk assets are trending lower. Yesterdays Fed pivot towards inflation slayer lead to an initial rally. However, today the direction is clearly down. Not good.

Short-term investor’s looking to short this market might want to be careful. Bear markets produce violent short covering counter trend rallies. Be sure to have “buy stop” orders in place to protect your shorts.

Long-term investors could care less about short-term volatility. Instead, this cohort should build their watch lists and look for inflation to rollover. Once inflation is under control, buy with both hands and two feet!

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.