How to play the Fed into year end? An interesting question that’s on everyone’s mind after yesterday’s FOMC meeting.

The FOMC hiked the terminal rate by 75bps. Not a surprise, the hike was baked into the market, but Powell’s comments afterwards during the press conference were not. Thereby illuminating year end investment decisions.

Here’s how the meeting unfolded:

First, the statement itself, “in determining the pace of future (rate) increases, the FOMC will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affect economic activity and inflation and financial developments.”

Translation – no surprises, stocks off to the races and USD weakened. Bullish response.

Then the press conference is when three bombs went off.

Bomb #1 – “Incoming data since our last meeting suggest the terminal rate of Fed funds will be higher than previously expected.”

Translation – no pause or pivot. Bearish risk assets. Sell risk assets.

Bomb #2 – “What’s far more important now is for how long rates will remain high, and we’ll stay the course until the job is done (inflation come down to 2%).”

Translation – if real UST 5yr real yields stay above 1%, markets believe Powell. He’ll hike rates into a recession. Sell risk assets.

Bomb #3 – “Risk management is key here, if we were to overtighten we could use our tools to support the economy later on, but if we failed to tighten enough inflation could become entrenched and that would be a much bigger problem.”

Translation – a big hawkish left hook, the Fed is not tight enough! Wow, markets were not expecting a pivot to a more hawkish Fed.

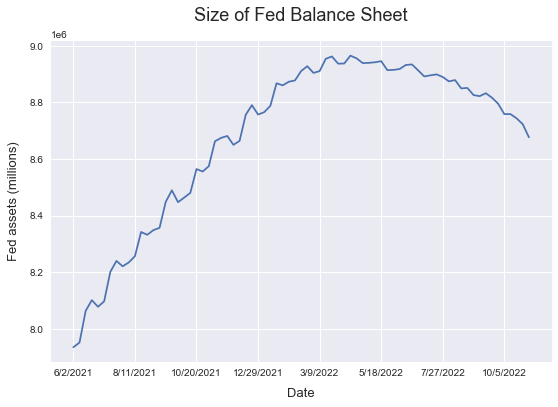

If three bombs were not enough, don’t forget quantitative tightening is underway. The Fed balance sheet declined by $72.4 billion in September adding to the liquidity drain. To be clear, risk assets rally when liquidity is ample and flowing, the opposite is occurring.

Don’t fight the Fed.

Current long-term portfolio considerations

- Get tax loss selling out of the way now, if not already

- Tighten up bond duration, if not already

- Underweight equities, if not already

- Overweight cash is a good idea

Final thoughts

I find it ironic and mildly frustrating that the Fed is more hawkish now than before the meeting. For sure, it’s tough to own risk assets right now. Besides the energy sector, all year long investors are selling equity and bond rallies. I expect this trend to continue into year end.

Clearly, this offers an excellent trade into year end. Keep doing what’s working.

An interesting pattern that traders follow is the typical year end mid-November to end of December rally in risk assets. I think it’s a decent patter to consider when liquidity is flowing and inflation is not making headlines. However, we’ve got a terrible setup this year. Therefore, the trade is to short equities and bonds via two ETFs designed for this type of short-term trade, SDS and TBT.

Short-term tactical trades

- Long SDS at $49.25, with a $44.98 stop loss and a $60.00 take profit (risk 8.6% to make 21%)

- Long TBT at $35.50, with a $34.68 stop loss and a $41.22 take profit (risk 2% to make 16%)

Size your risk appropriately. Remember avoiding risk of ruin is rule number when trading short-term views.

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.