Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

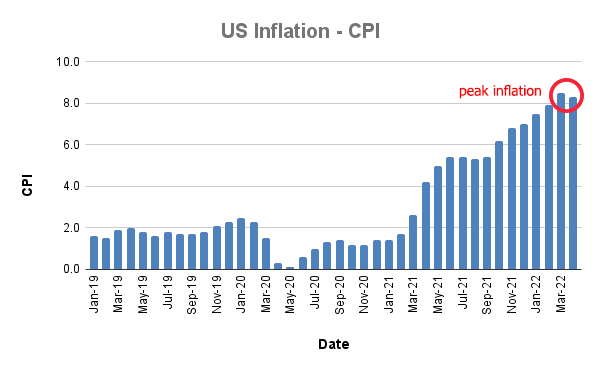

CPI – US Inflation

Obviously inflation is hard to ignore these days. This morning the US Bureau of Labor Statistics released April inflation data. Not surprisingly, inflation was higher than economists had forecasted. Besides the negative commentary provided by financial TV, I think inflation has peaked. I’d assign a probability of 60% that peak inflation is behind us. I know it’s only one data point, but we didn’t make a new CPI high. Peak inflation could be in the rearview.

Relief Rally

I estimate the probability (~80%) of a bear market NASDAQ rally plausible at this point. A common feature of bear markets are violent short covering rallies. To be clear, a short covering rally is when a bearish investor squares up her position by buying back shares to reduce risk. Short covering rally’s feed on themselves and can lead to huge rallies to the upside during bear markets.

I plan to capture the short covering rally when it occurs. So, I’ll wait patiently and I’ll let you know when it happens.

Conclusion

As always negativity bias runs amuck everywhere in our lives. It’s a well known that negative headlines get more clicks and sells more advertising. If you were to tune into CNBC or Bloomberg you’d think the world is ending. I’m not so sure.

Long-term investor’s should stick to their financial plans. Anyone with short-term liquidity needs might want to raise cash when the opportunity presents itself.

All in all, stocks are on sale in an inflationary environment with many headwinds to global growth. To be clear, this is a challenging environment to be an investor or trader. So, make sure guardrails are up on your risk management framework.

Be flexible. Trade your own ideas. Love everyone. Call you mom.

Yesterday’s post highlighted three stocks I’m keeping a close eye on.

Alpha Dawg – daily notes on investing and trading for self-directed investors and traders looking for trading ideas and novel ways to manage risk.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.