Yep, that’s right! It’s back, the Ultimate Investor Update #11.

The point of this article is to quickly review global finance and determine if it’s safe to own risk assets. I do that by covering 3-5 markets each update. Sometimes I dive deep into a particular market because a huge narrative has surfaced unexpectedly. Often times, it’s just a quick summary that anyone can hopefully follow.

Holy Grail Markets To Watch – technical analysis driven

- Bond Market (10yr US treasury)

- US dollar (dxy)

- Crude Oil

- Bitcoin

10yr US treasury

General market wisdom goes like this, if inflation is a threat, interest rates should go up. Well, is that the case right now? A quick look at the chart shows two previous highs in yields, meaning inflation was more of a concern back in March and May. So, all the hype about inflation today is nonsense, according to the bond market, or transitory.

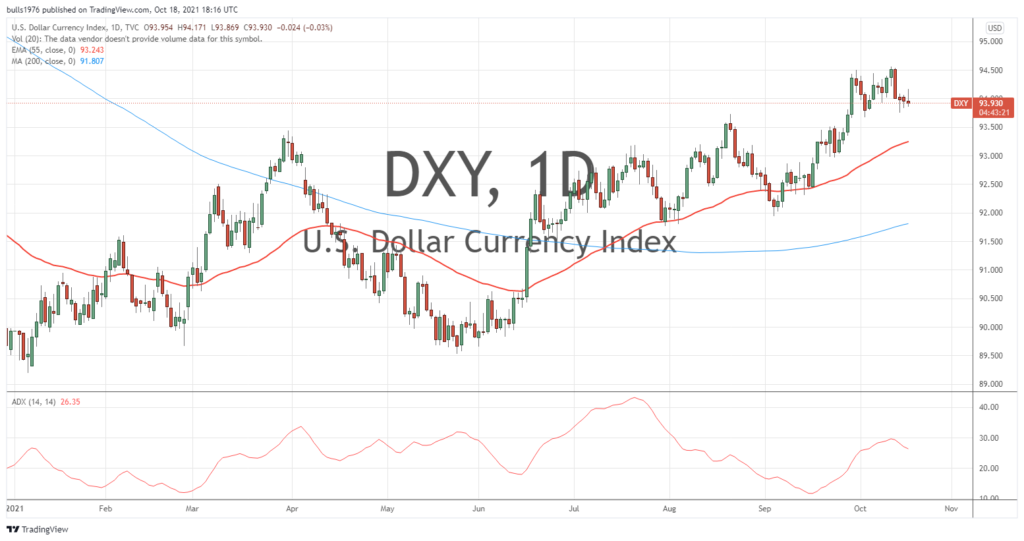

US Dollar

At the moment, the currency markets are a mess individually speaking. The USDCAD is dropping like a stone while the USDJPY is ripping higher along with the long trek lower for the EURUSD. However, the macro view for the US dollar (DYX – a currency basket index) looks to be drifting higher. This is supportive to stock prices.

Crude Oil

I’ve never seen a stock market rally last without the participation from the energy sector. Put another way, if the price of oil is ripping higher economic growth must be pretty good. Well, we’ve got the wind at our backs thanks to the monster rally in crude oil. Q3 earnings might be a good buy the rumor sell the news kind of trade. Regardless, the oil rally is catching the attention of big money and tourists are still waiting for a “pullback.” If you’re looking for an entry point, the $76 – $77 level looks reasonable.

Bitcoin

Never in my life have I ever witnessed a market as volatile as Bitcoin. I’m also sure gold bugs are crying the blues as “safe haven” money flows have found a new home. Nevertheless, the massively important high at $64,895 looms ahead. The setup looks pretty straight forward: 1) wait for a break above resistance before buying or adding, or 2) setup buys at the key support levels. Either way, the trade execution seems pretty manageable.

Conclusion

In the final analysis, the S&P 500 just completed its first legit correction of the year. Better yet, the correction matched perfectly with the seasonally weak Sept 23rd – Oct 9th time period. The setup into year end looks good for the stock market. Thankfully China’s real estate meltdown appears to be contained. I say that with a grain of salt.

–

DISCLAIMER: Content provided in this document is for your informational and entertainment purposes only. This document is not a solicitation for an investment, is not comprehensive, and should not for the basis for any investment decision. This document is not an offer to sell or a solicitation of an offer to buy any securities, commodities, or financial instruments, and my not be relied upon in connection with the purchase and sale of any instruments or interests in investment vehicles. This document should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this document.

Mikehoganonline (“MHO”) strongly suggests that you obtain independent advice in relation to any investment, and with respect to any financial, legal, tax, accounting or regulatory issues resulting form such an investment. In addition, because this document is only a high-level summary: it does not contain all materials terms pertinent to an investment decision. This document should not form the basis for any investment decision. Information contained in this document has been obtained from sources that MHO believes to be reliable, however MHO make no assurance or guarantee that such information is true and/or accurate, and MHO expressly disclaims liability arising form the use of information contained herein.

This document contains statements of opinion. These statements of opinion include, but are not limited to, MHO’s analysis and views with respect to: digital assets, projected inflation, macroeconomic policy, the market adoption of digital assets (including Bitcoin and Ethereum, and Blockchain), technical and fundamental analysis, financial planning, and the market in general. Statements of opinion herein have been formulated using MHO’s experience, research, and/or analysis, however, such statements also contain elements of subjectivity and are often subjective in nature. In addition, when conducting the analyses on which it bases statements of opinion, MHO has incorporated assumptions, which in some cases may prove to be inaccurate in the future, including in certain material aspects. These analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing in this documents represents a guarantee of any future outcome, or any representation or warranty as to future performance of any financial instruments, credit, currency rate, digital currency or other market or economic measure. Information provided reflects MHO’s views as of the date of this document and are subject to change without notice. MHO is under no obligation to update this document, notify any recipients, or re-publish the content contained herein in the event that nay factual assertions, assumptions, forward-looking statements, or opinions are subsequently shown to be inaccurate.

© 2021 mikehoganonline.com, All Rights Reserved