Jackson Hole signaled higher rates ahead and investors dump stocks and question what to do next.

Jay Powel was crystal clear, higher rates are coming and stocks will not be bailout out this time around. Wise market participants realize the Fed Put is dead. Another way of saying, we won’t cut rates if economic growth weakens and inflation is still high.

The challenging question remains, “how long until we get to 2% inflation?” Until then, its tighter liquidity conditions across all markets.

Generally speaking, tighter liquidity is a head wind for equities. So, it makes sense to underweight equity exposure.

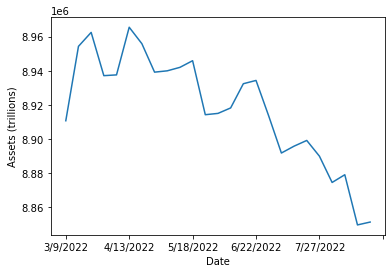

To make matters worse, quantitative tightening (QT) is about kick in. To recap, QT is a monetary measure which sells Fed assets into the market, like US treasuries and MBS-like assets. As the Fed unloads its balance sheet on the market driving prices down and rates up, tightening liquidity further.

The Global Marco setup is not friendly to economic growth, but do leading economic indicators agree?

Let’s check in on the following leading growth indicators:

- US Conference Board Top 10 Leading Indicators

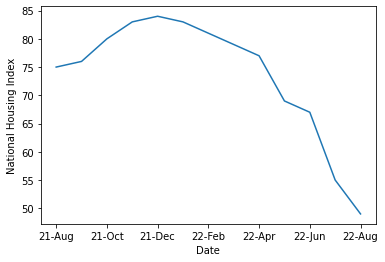

- NAHB Housing Index

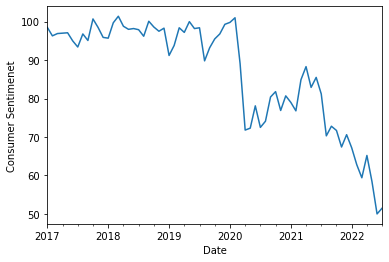

- University of Michigan Consumer Sentiment Index

US Conference Board Top 10 Leading Indicators

NAHB National Housing Index

University of Michigan Consumer Sentiment

All three leading indicators provide anecdotal evidence the economy is slowing. Therefore, positioning defensively makes sense here.

Trade update

Back on August 11th I initiated two trades: 1) long SPY at $420 and 2) long DVN at $64.45. The SPY trade stopped out on Friday. However the DVN trade is working and is sitting on a 15.7% gain. Today I’m going to move the stop up to $69.95. I don’t want this trade to reverse course and give up its gains, so moving the stop higher is an easy way to manage risk.

Conclusion

In a nutshell, leading economic indicators are flashing signals that economic growth is slowing. A defensive allocation to safety-like assets is warranted.

Last Friday at Jackson Hole, Jay Power, chair of the Fed confirmed the following with regards to fighting inflation:

- current rates are too low

- economic growth needs to slow

Absent from the prepared remarks was the impact Quantitative tightening will have on markets. The size of the Feds balance sheet is a good way to view QT. You can see the balance sheet starting to shrink – meaning rates are going higher! Expect a big rollover in the series going forward.

Size of Feds Balance Sheet (QT measure)

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.