(456 words – 4 minute read)

Stocks look droopy as the new year short squeeze fizzles and season flows into retirement plans dry up. Now yields are on the move higher with the US 10yr sitting at the key 3.9% level.

Yields are not scary yet, but if bond volatility continues higher along with yields pushing firmly through 3.9%, risk assets are going to have a tough time. Dr. Copper is the remaining bastion of hope for the 2023 bull market as Chinese equities drop persistently from recent highs. However, copper is rolling over today. Not a good sign.

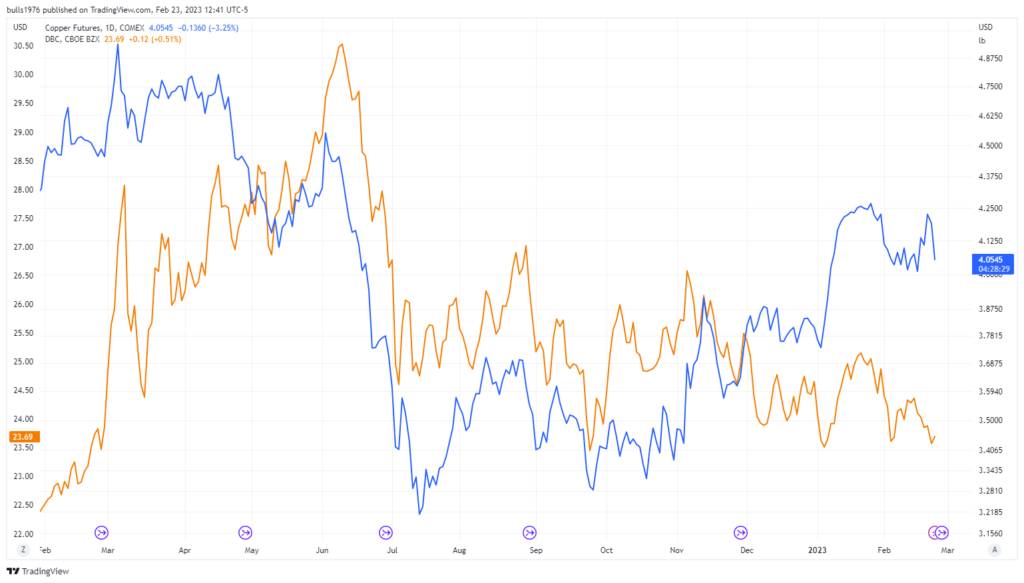

DBC Commodity Index vs Copper

Commodities are flashing mixed signals with copper (blue line) looking strong supporting the soft landing narrative, but DBC commodity tracking ETF (orange line) looks heavy. One way or another, this situation will resolve itself and provide investors with the path of least resistance.

As a side note, since the PMI release on Feb 16th risk assets have hit a wall. The response from investors was to dial back risk and seek further confirmation on the direction of inflation. To be sure, the disinflationary trend from Q4 2022 no longer looks like a sure thing.

Final Thoughts

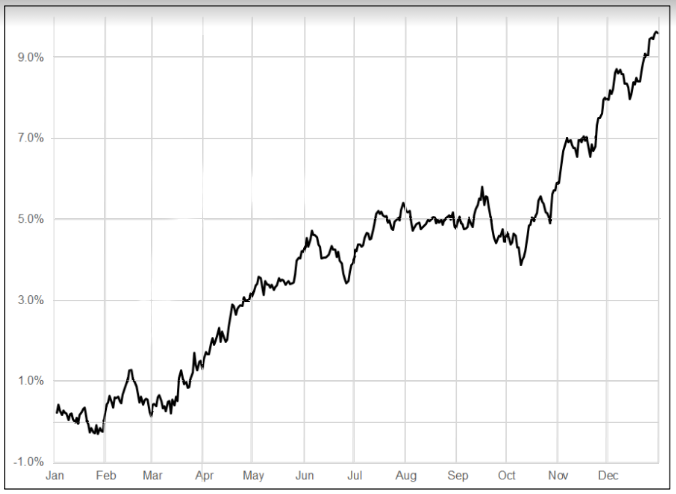

To wrap up today’s post I thought a look at equity seasonality might be helpful. As shown below we are entering a seasonally weak period until mid-March where equities are expected to perform poorly. The seasonality is not set in stone, but it can be a helpful guide when assessing risk. Note that other weak periods for equities is June and mid-September to mid-October.

Average Equity Seasonality since 1990

In the final analysis, we need more clarity around the possible economic outcomes before adding additional risk to he portfolio. At this point, the expected returns are not worth the risk, in my opinion.

An investor always has the choice to do nothing, or sit on their hands, but most fail to have this level of self control.

No changes to the asset allocation of our flagship ETF portfolio. Staying defensive for now, and keeping a close eye on the economic data and for any opportunities.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, if you don’t already have one.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.