Personal consumption expenditures (PCE) price index is known for capturing inflation (or deflation) across a wide range of consumer expenses in the US.

Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

Today we dive head first into inflation. Exciting stuff I know.

Inflation blues

Today’s note is about inflation. I think of inflation as theft by stealth. You can’t see it, but you know its there. Slowly eating away at the edges. Relentless. Undeniably, keeping an eye of inflation is a top priority.

For the fact checkers out there, you can access PCE data from the Bureau of Economic Analysis, US Department of Commerce. It’s free! You gotta love the internet.

The PCE price index is the primary measure of inflation used by the Federal Reserve since 2012. The PCE in not the only measure of inflation, but it’s a good one.

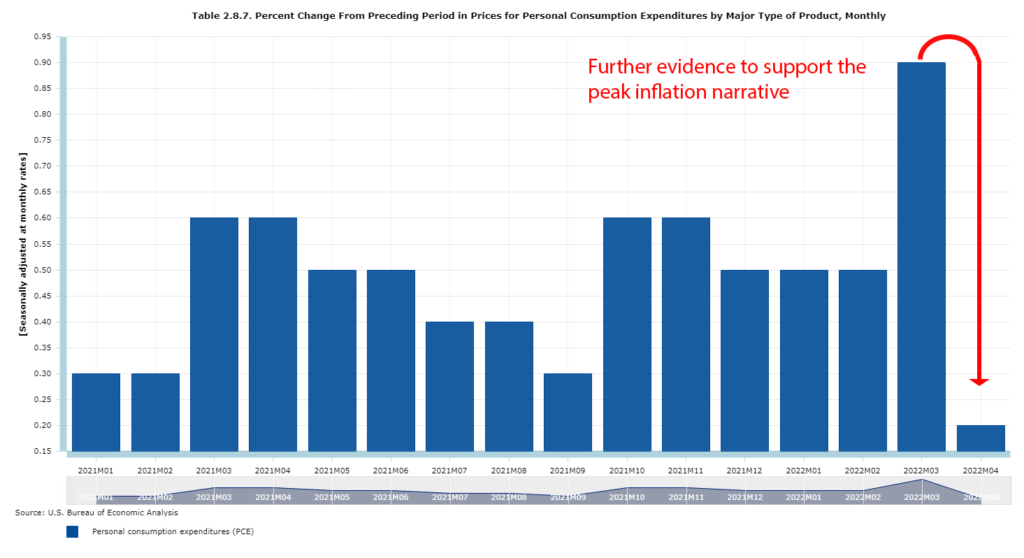

Indeed, the charts below provide more support that inflation is cooling. Earlier in May my posts “Inflation running hot stocks not” and “April US producer price index falls” shore up the idea that inflation has peaked.

PCE – all goods including food and energy

To be sure, it’s hard to argue that inflation is still raging given the PCE nosedive in April. I mean WOW, that’s a big drop!

PCE – food only

Unfortunately for consumers the recent cooling of inflation has yet to transition to food prices in a meaningful way. However, April revealed a reversal in the trend. This is good news. Albeit not earth shattering news.

Conclusion

To sum up this post, inflation is cooling but remains sticky high. Despite this can the consumer keep spending? A tough call indeed. Given the uncertainty around geopolitical events in China, sticky high oil prices, and the ongoing global Central Bank tightening cycle, I expect a bumpy road ahead for equities and other risk assets. Short-term traders take note. Long-term investors could care less.

I have no strong views short-term. Today’s stock market rally is a good start, but I’m not quite ready to buy. Yet.

Alpha Dawg – daily notes on investing and trading for self-directed investors and traders looking for trading ideas and novel ways to manage risk.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.