Today news leaked that salesforce.com (NASDAQ: CRM) wants to buy Slack Technologies Inc (NYSE: WORK).

Why this big acquisition? Well, do you ever have to sort through an email tread a mile long? I do. And I hate it!

Well, the business world is working to solve this problem. The basic idea is to work smarter not harder.

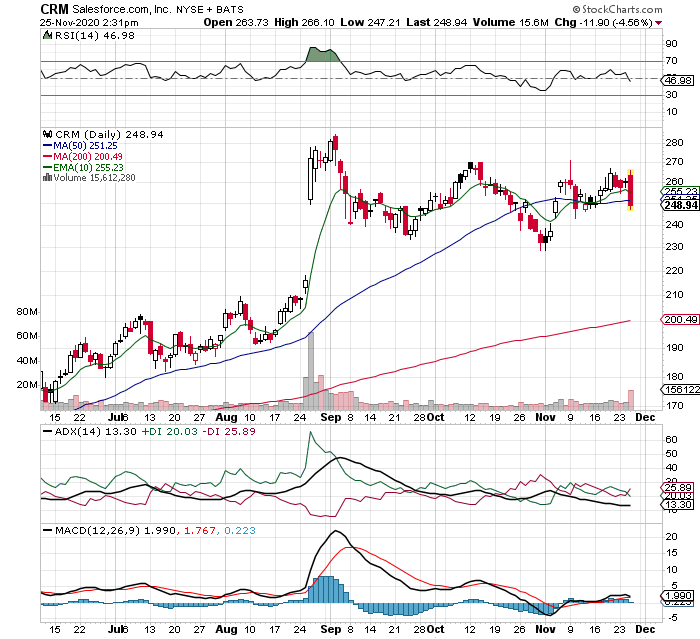

Salesforce pioneered cloud computing solutions for business to tackle this problem. Not surprisingly, salesforce.com earnings keep exceeding expectations. As a result, the share price keeps moving higher.

Todays news knocked salesforce stock down almost 5%. This is a great buying opportunity. Naturally, salesforce sees Slack as an emerging competitor. So, why not buy them out!

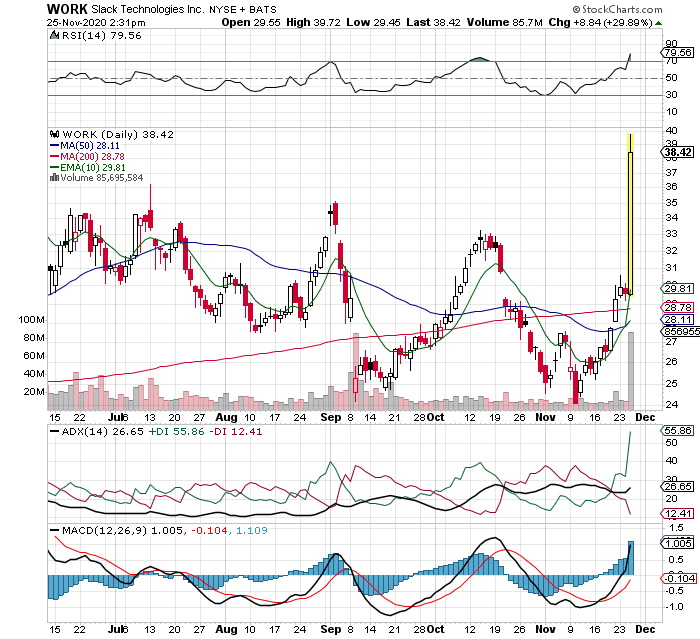

Moving on, Slack Technologies operates a cloud based software platform to help business be more efficient. Sound familiar? Remember the silly email thread problem. To be sure, salesforce.com views Slack as a good fit. Investors think so too. In fact, Slack’s shares exploded 30% today!

Clearly, investors believe this is a good deal for Slack shareholders. More importantly, Slack’s most recent earnings point towards profitability in the near term. In other words, Slack is finally ready to grow earnings. But how fast will earnings grow?

Conclusion

Simply put, salesforce.com is a force to be reckoned with. If today’s news is true, that salesforce wants to buy Slack, it’s another example of how computer technology continues to:

- disrupt the “regular way” of selling stuff

- great companies buy future competitors

- efficiency leads to bigger profits

- earnings growth leads to higher stock prices

In the end, salesforce belongs in your portfolio. Buy the stock when its price is weak like today. Also, salesforce is a long-term hold. The best strategy is to keep adding to your position over time.

On A Side Note

Are you looking for another company with terrific earnings growth? Have a look at The Trade Desk. Recently I covered this company and its bright future.