Sector rotation to start the year, not a surprise given the setup going into year end. However, the big question is whether or not the Fed will commit a policy error. Traders are on the watch for a 2018 Q4 disaster. Time will tell.

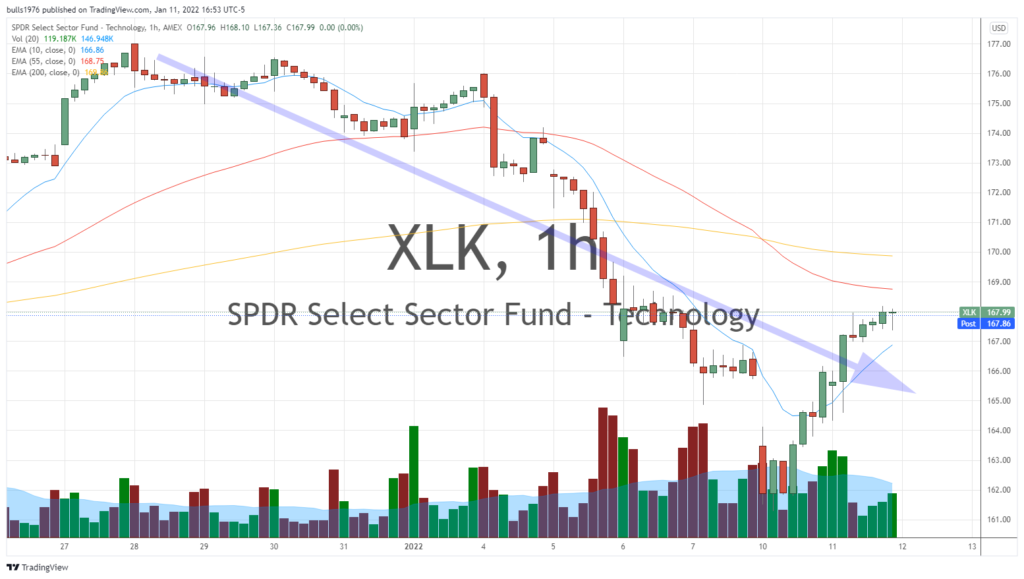

To summarize, this week’s trading action is tied to the now oversold tech sector. Sure, any market that is extended way above its 200 day moving average is ripe for a mean reversion trade. Sure enough, looking back the charts tell the story. Late December tech way above 200 day, now way below! See-saw price action.

As of today, the tech sector looks like a buy if you’re a swing trader. Also, long term PMs who are underweight tech might be chomping at the bit to hit the bid down here. Again, time will tell.

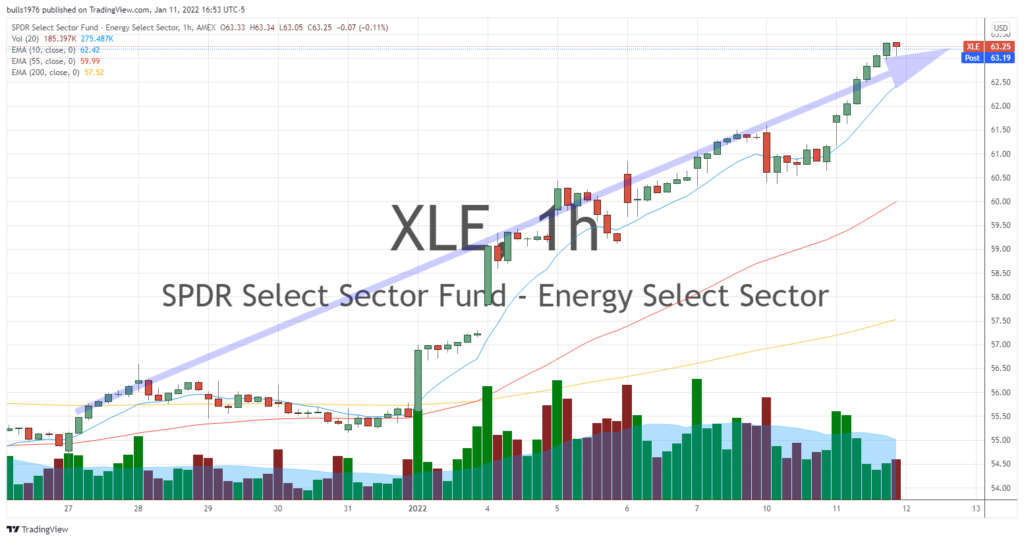

Certainly, it’s hard to dismiss high inflation when you take a look at this week’s price action in the energy sector. My guess, pension and big institutional money view energy as a must own sector this year.

Of course, the financial sector can never be left out. After all, investor’s are starving for yield, so it’s a no brainer to buy financials. But, keep and eye on the yield curve. The steeper the better.

Conclusion

To be sure, a sector rotation to start the year has been the market’s opening salvo. The influx of capital from the tech sell off (or mean reversion if you’re into math) is finding its way into financials and energy sector. Indeed, with the Fed set to end quantitative easing, and possibly beginning quantitative tightening, while teeing up rate hikes this year, anything can happen. The risk of policy error has never been higher. So, we have a big sector rotation to start the year and it’s just week one. Buckle up!

–

Find out what’s driving markets –>

–

RED HOT STOCK –>

DISCLAIMER: Content provided in this document is for your informational and entertainment purposes only. This document is not a solicitation for an investment, is not comprehensive, and should not for the basis for any investment decision. This document is not an offer to sell or a solicitation of an offer to buy any securities, commodities, or financial instruments, and my not be relied upon in connection with the purchase and sale of any instruments or interests in investment vehicles. This document should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this document.

Mikehoganonline (“MHO”) strongly suggests that you obtain independent advice in relation to any investment, and with respect to any financial, legal, tax, accounting or regulatory issues resulting form such an investment. In addition, because this document is only a high-level summary: it does not contain all materials terms pertinent to an investment decision. This document should not form the basis for any investment decision. Information contained in this document has been obtained from sources that MHO believes to be reliable, however MHO make no assurance or guarantee that such information is true and/or accurate, and MHO expressly disclaims liability arising form the use of information contained herein.

This document contains statements of opinion. These statements of opinion include, but are not limited to, MHO’s analysis and views with respect to: digital assets, projected inflation, macroeconomic policy, the market adoption of digital assets (including Bitcoin and Ethereum, and Blockchain), technical and fundamental analysis, financial planning, and the market in general. Statements of opinion herein have been formulated using MHO’s experience, research, and/or analysis, however, such statements also contain elements of subjectivity and are often subjective in nature. In addition, when conducting the analyses on which it bases statements of opinion, MHO has incorporated assumptions, which in some cases may prove to be inaccurate in the future, including in certain material aspects. These analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing in this documents represents a guarantee of any future outcome, or any representation or warranty as to future performance of any financial instruments, credit, currency rate, digital currency or other market or economic measure. Information provided reflects MHO’s views as of the date of this document and are subject to change without notice. MHO is under no obligation to update this document, notify any recipients, or re-publish the content contained herein in the event that nay factual assertions, assumptions, forward-looking statements, or opinions are subsequently shown to be inaccurate.

© 2022 mikehoganonline.com, All Rights Reserved