Technology stocks are set to soar to new highs, and Taiwan Semiconductor Manufacturing (TSM – NYSE) is set to dominate the microprocessor market.

Financial TV experts claim otherwise, but intelligent investors ignore their rubbish. Ever since January 2020, cable TV networks like CNBC, MSNBC and Bloomberg have warned investors that carnage awaits the technology sector. They could not be more wrong.

TSM owns the largest microprocessor foundry in the world. As a result, they control 50% of the market. If that wasn’t enough, TSM leads the way in producing cutting edge 5 nanometer (nm) chips AND they will be the first company to produce 3 nanometer (nm) chips. Not only that, but TSM recently invested $20 billion into its state-of-the-art fabrication facility.

Under these circumstances, it’s no wonder companies like Apple, Qualcomm and Nvidia crave microprocessors made my TSM.

At the same time, competitors like Intel (INTC – NYSE) are struggling with the production of their 7 nanometer chips.

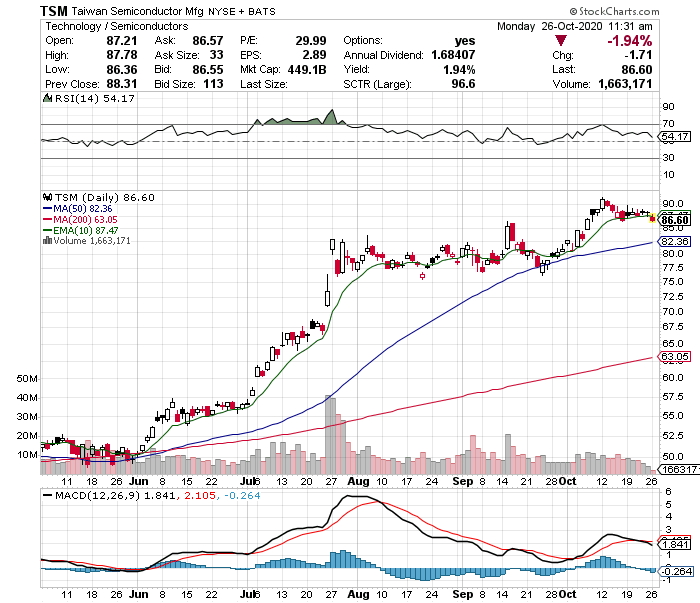

Not surprisingly, this opens the door to big gains for TSM shareholders. Investors should sit up and take notice.

Despite TSM’s strong market position, the company decided to go a long with the US Commerce Department’s decision to prevent Huawei from acquiring any chips that use American Intellectual property. As a result, the decision disrupted the global supply chain to the company’s benefit. Overtime, two supply chains will develop, but for now, Huawei is in a tough spot.

Given TSM’s scale and technological brilliance, competitors aren’t likely to catch up anytime soon.

Conclusion – Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing is the reigning king of microprocessors. Their market share is huge and will likely get bigger. In the long run, the battle between the US Commerce Department and Huawei will benefit shareholders. The company’s shares worth buying into any market weakness.

Looking for technology company that is disputing the status quo?

Check out my post on MongoDB. Here is another company changing the world with a new technology.