U.S. initial jobless claims measure the number of individuals who filed for unemployment insurance for the first time during the past week.

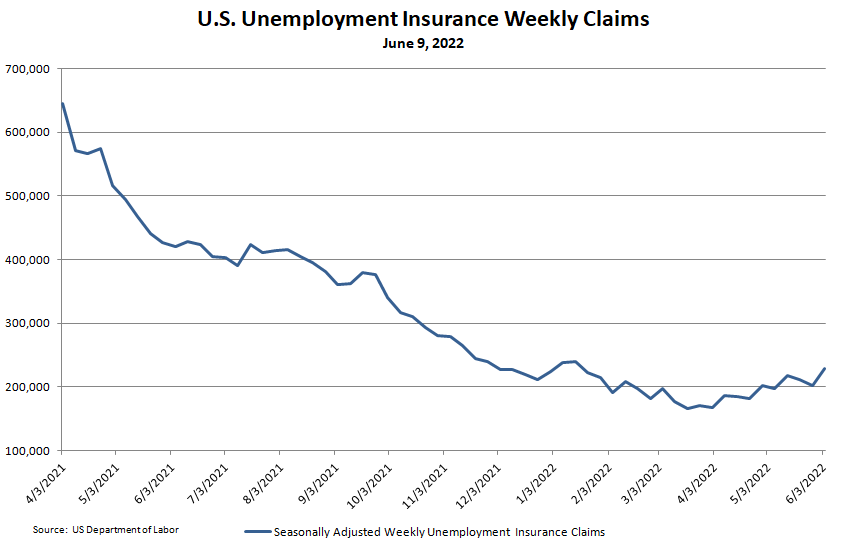

Since March of this year weekly unemployment claims have ticked higher. To be sure, this is not a sign of economic strength, but it’s not a death sentence either. More likely, it’s something to keep an eye on going forward.

Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

Not a surprise

Since the beginning of the year layoffs and hiring freezes at big tech are a common theme. However, it’s yet to be determined if this trend is spreading to other sectors of the economy. So, it’s a wait and see kinda thing right now.

Note in the chart below the slight uptick in jobless claims. Nothing crazy, but flying under the radar nonetheless.

Leading indicator

I like the weekly jobless claims series because it’s the only leading employment indicator. Despite this, Wall Street focuses on nfp payrolls (first Friday of every month), a coincident indicator. Last Friday the consensus view of the nfp was positive. Not a market mover at all. So, maybe we can get an edge here.

Bottom line, employers appear to not be in a hiring mood right now.

A bunch of red flags and one green

Here are the red flags signaling caution:

- record high gasoline prices

- record high food prices

- rising interest rates globally

- QT (quantitative tightening – aka liquidity vacuum)

- record debt levels

And the one green flag is the energy sector. My thesis is if oil prices remain high, energy stocks keep going higher.

Time will tell, but I think if rates can stay “generationally low“, by that I mean less than 4% on the US 10-year note, things will not fall apart. No crisis.

The big unknown facing investors right now is ….

Can the Fed raise rates high enough from the zero lower bound to have ammo to cut and boost liquidity when (not if) the recession hits?

Conclusion

To sum up this post, jobless claims are on the rise possibly signaling an economic slowdown lies ahead. On the other hand, a myriad of challenges face everyone due to red hot inflation. Everybody is getting squeezed, business included.

I have no strong views short-term. However, you can’t ignore the oil rally. It’s one of those situations where opportunities to buy are rare, you just have to bite your lip do it!

Yesterday I bought Ensign Energy Services for this very reason. Exposure to energy is the only game in town if you want to outrun inflation. Including risk management, the whole trade setup can be found here.

Enjoy! Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.