Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my trading ideas, analysis, and novel ways to manage risk in these volatile markets. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

They say consumers account for 75% of economic spending and are in the driver seat. If so, it makes sense to get a feel for the consumer. A finger in air kind of test would work. One useful measure of consumer health is the Michigan Consumer Sentiment Index (MCSI).

The monthly survey (MCSI) gauges how consumers feels about:

- the economy

- personal finances

- business conditions, and

- buying conditions

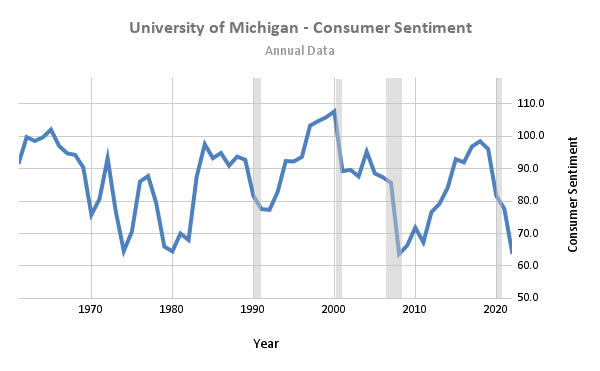

Generally speaking, the MSCI is a great recession indicator. When consumer sentiment is less than good, the economy usually follows suit. Sharp drops in consumer sentiment have lead to recessions in the past. The chart below shows US recessions in gray and the level of consumer sentiment. The last four recession all were preceded by sharp drops in consumer sentiment. Not the setup for big long positions.

The problem we have today is the continued downward trend in consumer sentiment. To be sure, at the outset of the pandemic the US economy briefly entered a recession. However, the swift and massive monetary response from the Fed and other Central Banks shocked growth back to life. The recession was over before it started.

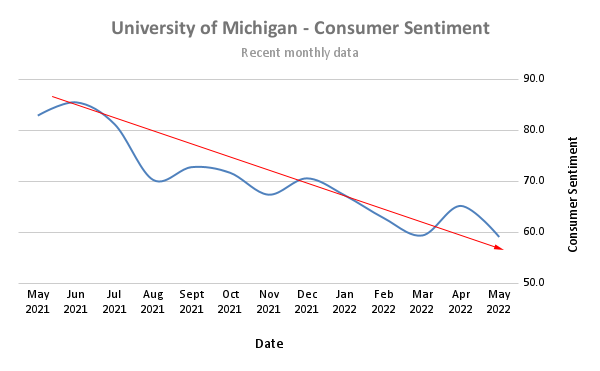

Fast forward to today, interest rates are rising, inflation is hot, and consumer sentiment is still falling. See recent MSCI data below, it’s ugly. To me this makes the bullish case for owing equities short-term tough to swallow, at least until sentiment improves. On the other hand, long-term investors could care less because the right stocks create enormous wealth over time.

Conclusion

For the most part, consumer sentiment data is dreadful and getting worse. With this in mind, investor’s might want to use caution trying to buy the dip. No doubt, rising interest rates and falling consumer sentiment is not a bullish brew. I think any rally the stock market near term will be sold until some bullish (or dovish if you like birds) catalyst emerges. Until then keep the risk guard rails up! Avoid risk of ruin.

Be flexible. Trade your own ideas. Love everyone. Call you mom.

If you’re looking for analysis on inflation see here and here.

Alpha Dawg – daily notes on investing and trading for self-directed investors and traders looking for trading ideas and novel ways to manage risk.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.