Stock markets are finally trading post US election results. Well, not really. We still don’t have an official result. But investors appear to care less.

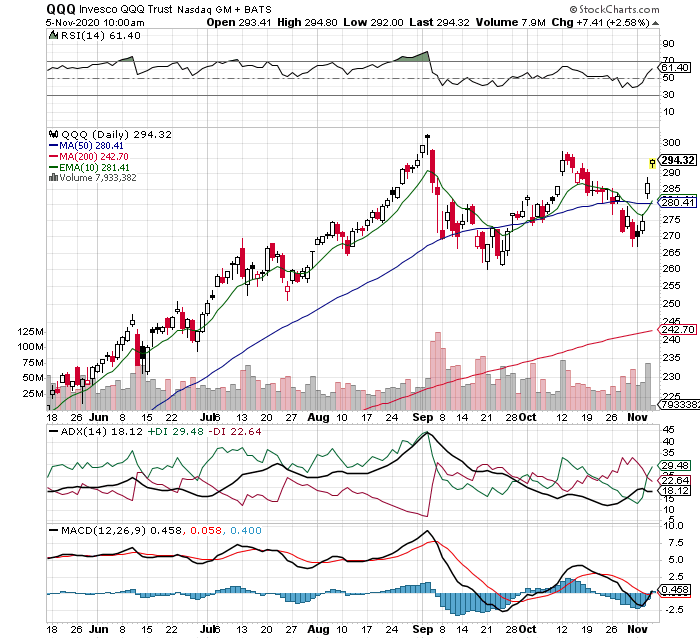

Take a look at the NASDAQ 100 price chart below. In three trading sessions we’ve managed to rise within striking distance of an all time new high! Incredible!

Technical analysis suggests a new rally is underway. However, we do need to see buyers step up and follow through on yesterday’s buying spree. At the open today, investors were doing exactly that, buying more stocks!

At this point it makes little sense to chase this rally. Prices have risen way to fast in the face of uncertain election results and the pandemic. In the near future, investors will face the reality that fiscal stimulus could be less than expected (or maybe more, we don’t know). Furthermore, stock valuations may still need to discount recent pandemic related lockdowns in Europe.

Most important of all, stocks are the only asset that offer the potential to gain from both cash flow (dividends) and price appreciation (capital gains).

Bonds are no longer a viable long-term investment. They no longer pay interest higher than the rate of inflation. A bonds ability to appreciate in price is muted since rates are pinned at zero. Bonds should only be used as a short-term investment vehicle to parks funds or part of an asset allocation. Bottom line, bonds are a terrible investment at the moment.

As a result, money will continue to flow out of bonds and into stocks. No rational investor will keep money invested in an asset which returns less than the rate of inflation.

Conclusion

Investors are leaving the bond market faster than Covid-19 is spreading. This is the main reason why Quantitative Easing has been adopted by every major central bank in the world. Central banks had no choice but to step in, otherwise there would be no buyers and interest rates would skyrocket!

Why bonds are such a bad investment?

Simple. Figure out the real rate of return and you’ll see why.

Bond Interest Rate – Inflation = Real Rate of Return

1% – 2% = -1% real rate of return

If you are a long-term investor in bonds, both corporate and government, you stand to lose a lot of money. A negative real rate of return is a guaranteed loss. Stocks offer investors the only refuge to avoid a negative real rate of return.

The bull market in stocks has a long road ahead regardless of the US election results.