It’s high time for a stock update. I’ve been so focused on the sector rotation trade and the crypto currency correction it slipped my mind to post an update.

With this in mind, here are some of the headlines driving markets today.

- Last week Elon Musk trashed crypto currencies in a Tweet, but still thinks they are a good thing long term

- The Israeli Palestinian conflict flared up…. again

- Inflation is running HOT, no surprise

- Massive media merger between AT&T and Discovery

F/X

Foreign exchange markets are the largest in the world. In fact, the US dollar is the big boy on the block. All other currencies come second. This is a huge advantage for America as it’s the Reserve Currency of the world. In the end, a countries currency is like their common stock. A strong currency is a sign of a strong economy.

So, we have a weak US dollar which generally a good thing for the stock market, but not necessarily for the US economy long-term.

Bonds – Interest Rates

On the other hand we have the bond or debt market. Indeed, the bond market is the most important market in the world. Surely, every major player in the world keys in on this market. Why? Well, it’s because we live in a debt based economy. If we’re unable to continually issue new debt the house of cards collapses.

To emphasize, if the bond market does not function smoothly we have big problems. To be sure, this is why the Federal Reserve uses quantitative easing as its main policy tool. So, it’s just a fancy way of creating debt on a massive scale even if there are no buyers. Crazy but true!

Together with a weak US dollar and a stable 10 year US treasury yield we have strong reason to believe stocks will continue trading higher.

Stocks

The goal of this post is to provide you with a stock update. Well, things are looking pretty good from my point of view. As mentioned above, the US dollar and interest rates are behaving in a manner that is supportive of stocks.

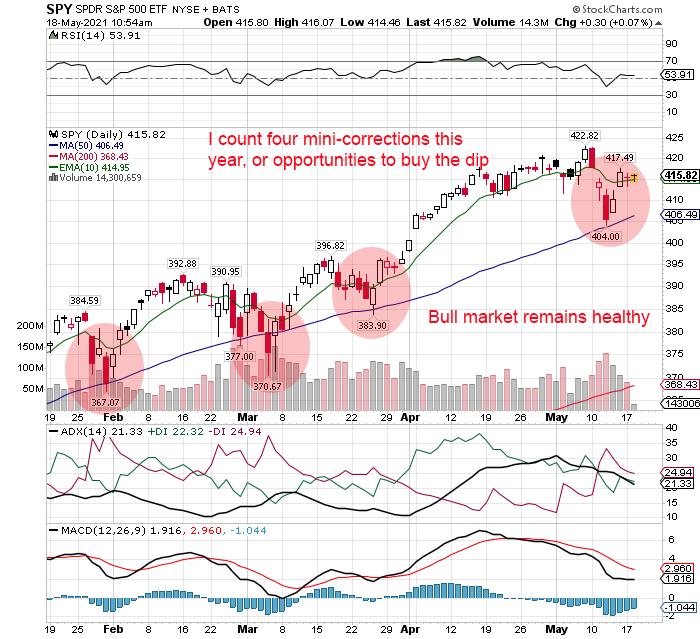

Another key point to consider is the buy the dip mentality. Clearly the chart below identifies opportunities to where investors bought the dip this year. Corrections have been short and shallow.

Unquestionably stocks remain in a bull market. Without a doubt stocks are a good bet against inflation. Surely you’ve noticed the price of everything is going up. And stocks are no exception. Over the course of time stocks have been the best hedge against inflation.

Conclusion

All things considered investing your hard earned money should not be stressful, but it is! That’s a fact! With any luck, I hope this post puts your mind at ease. Wall Street veterans like to say, “stocks climb a wall of worry”. Hopefully, now you understand how the US dollar and US treasury yields (interest rates) affect the stock market. If you do, you’ll sleep well at night.

Summing up, the greatest stock bull market in history has room to run higher.

If you are looking for new stock trades, then checkout my Ultimate Portfolio page. It’s free!

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved