Making use of market technical analysis gives you a competitive advantage and a boost to the bottom line.

This article, or update, aims to give you all the important information to keep your portfolio on track.

Of course, if things get crazy, you’ll find out what trades to make right here.

Holy Grail Markets To Watch – Technical Analysis

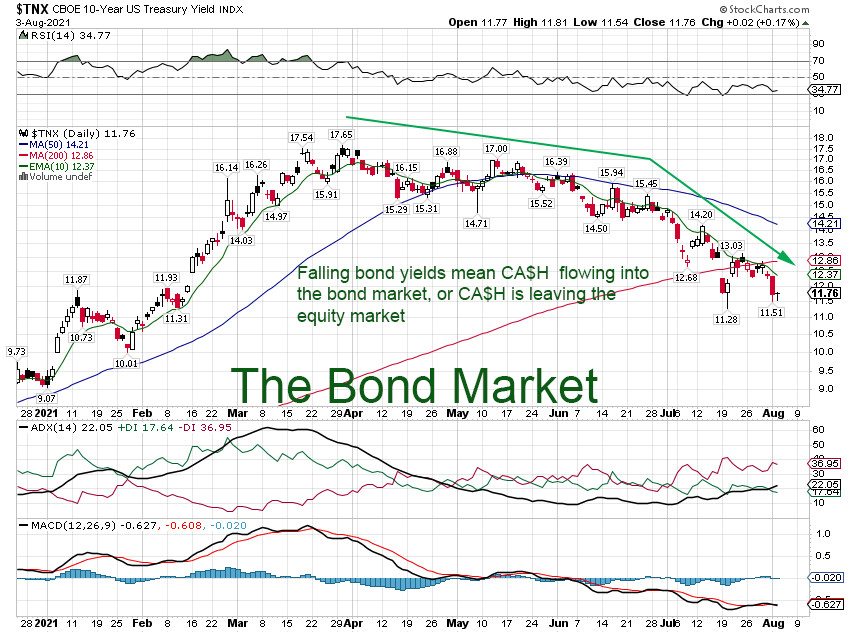

1. Bond Market

The bond market is the most important market on the planet. Every trader and investor worth one’s salt pays attention to the bond market. Obviously, there are many bond markets, but I’ll focus on the US 10-year treasury, always!

To be honest, there’s not much going on in the bond market right now. The Federal Reserve has the market’s confidence, so expect unlimited debt purchases to continue. Talk of any tapering is totally misleading, at least at this point.

From a trading perspective, the bond market is signaling equity prices could weaken in the short-term.

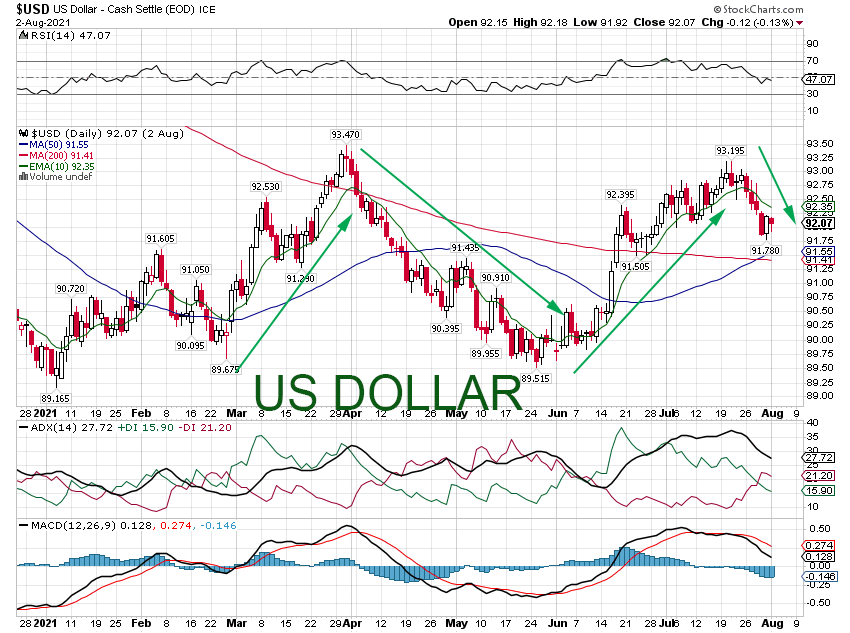

2. US Dollar

Paying close attention to the US dollar is vital to a successful portfolio. Simply put, if the dollar rallies persistently something is wrong somewhere in the financial system. Also, Federal Reserve monetary policy is based upon a weak dollar.

After all, debt levels must continue to expand to pay for growth and that’s the linchpin to the Federal Reserve’s monetary policy. Therefore, if the US dollar rallies, something is wrong.

From a trading perspective, the US dollar is behaving itself and is not flashing any red flags.

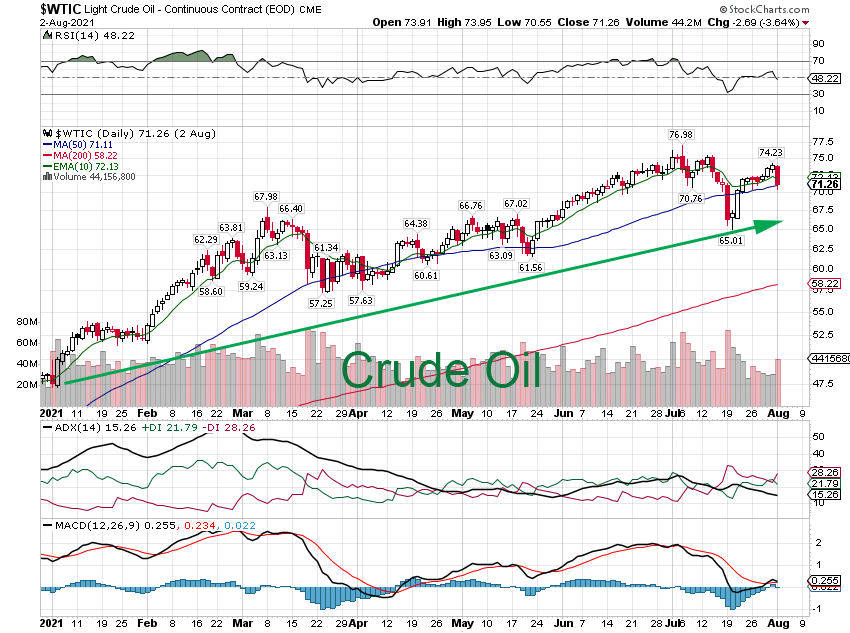

3. Price of Oil

Without doubt every stock market rally must be accompanied by a rally in oil prices. To be sure, this point is often overlooked by traders and investors. That is to say, if the price of oil is falling because of lack of demand, this implies the economy is slowing.

At this point, the price of oil is signaling the economy is expanding and stock prices should move higher.

Conclusion

To be honest, we’re in the dog days of summer. The Holy Grail of Markets is sending mixed signals based on market technical analysis. Therefore, all the Whales are enjoying their yachts and Hampton summer mansions. I expect markets to lack any signs of life until September. So, until then enjoy the summer and keep some powder dry.

Recipe for a Stock Market Rally

- Slowly rising yields

- Gentle devaluation of the US dollar

- An oil rally

If the above conditions exist, you have all the necessary ingredients for a sustainable market rally. If not, it would be prudent to be cautious.

Be sure to check out my last Ultimate Investor Update.

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved