Leading indicators say short stocks into the Fed Sept 21st meeting as inflation expectations fail to cooperate with falling energy prices.

Investor hopes of rapidly declining inflation is turning out to be a pipe dream of epic proportions.

Inflation expectations

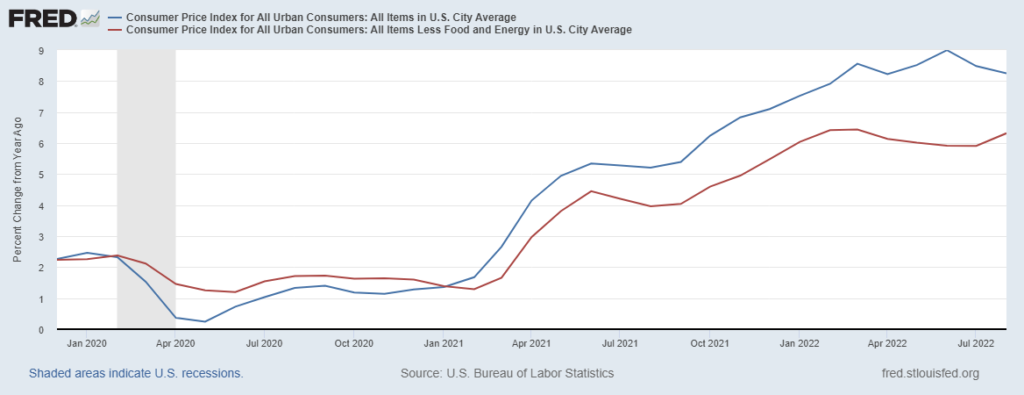

Today’s CPI data release from the Bureau of Labor Statistics came in hot at 8.25%, excluding food and energy 6.32%. Although headline CPI declined YoY, excluding food and energy CPI ticked higher 0.4%. Not good.

We get PPI data tomorrow, but I think the fox is already in the hen house, so even if PPI contradicts CPI (I don’t think it will) the damage is done.

CPI Chart

Equities look heavy

The S&P 500 index looks heavy right now as investors are ever so slowly coming around to the idea inflation expectations are moving in the wrong direction.

Die hard equity bulls are slowly but surely capitulating and realizing the summer equity rally was simply a bear market rally. Now, asset valuations need to adjust to a higher cost of capital than was previous believed possible.

The Fed pivot narrative is dead in the water, for now.

SPY ETF

New trade – short stocks

I like the idea of shorting stocks here. The setup is a classic buy the rumor sell the fact kind of trade.

Risk parameters are fairly obvious and the timeframe is pretty tight with the Fed meeting next Tuesday, Sept 21st. So, we have six days for this trade to play out. I will close this trade next Tuesday (20th) at 3:59pm. No need to carry risk into this event.

I’m going to use the Proshares UltraShort S&P 500 ETF (SDS) to execute this trade. This type of ETF is not a long-term investment for obvious reasons. I use it to strategically hedge equity risk and take advantage of opportunities, like now.

Defining risk parameters is straight forward. The June 15th S&P 500 low ($362.17 – SPY) looks like an ideal take profit zone. If not, I’ll exit on the 20th regardless. The $43.48 level looks like the ideal stop loss level.

To recap, I’m short the S&P 500 via SDS. Therefore, I’m long at $45.00 with a $43.48 stop loss risking 3.3% of fee capital to make 8.5%. Remember I’m closing this trade prior to next weeks Fed meeting not matter what kind of emotional biases try to alter the course!

Conclusion

In the end stocks are having a tough time post Jackson Hole when the Fed made it crystal clear rates are headed higher short-term.

Heading into September a cohort of investors believed CPI would soften materially in August. No dice. On the contrary, CPI ex food and energy moved higher and now they are scrambling to minimize the damage.

Long-term passive investors care less about short-term fluctuations like what I’m describing here. However, if you must invest capital for whatever reason, holding off until US mid-term elections are in the rearview mirror on November 8th makes sense.

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Trade and invest at your own risk. Trade your own view.