Is inflation sticky? No doubt, the ability to accurately forecast inflation is in question. After all, economists 2021 – 2022 inflation forecasts completely missed the mark. Are their models wrong? I think so.

In light of this failure, it makes sense to follow the data and make your own forecast. There are different measures like CPI, PPI and Core PCE. Today’s highlight is PPI, or prices at the wholesale level. Simply put, PPI focuses on production while CPI is all about the consumer.

Pay attention to core inflation data. The Fed focuses on core inflation, so should we.

To recap core PPI, its inflation data that strips out volatile food and energy prices. The Fed speaks to core inflation all the time. Clearly it’s important to monetary policy going forward.

So what are core producer prices telling us?

Basically the same story as CPI. Inflation is rising again on a monthly basis. The market was not expecting this outcome. Not good for risk assets short-term.

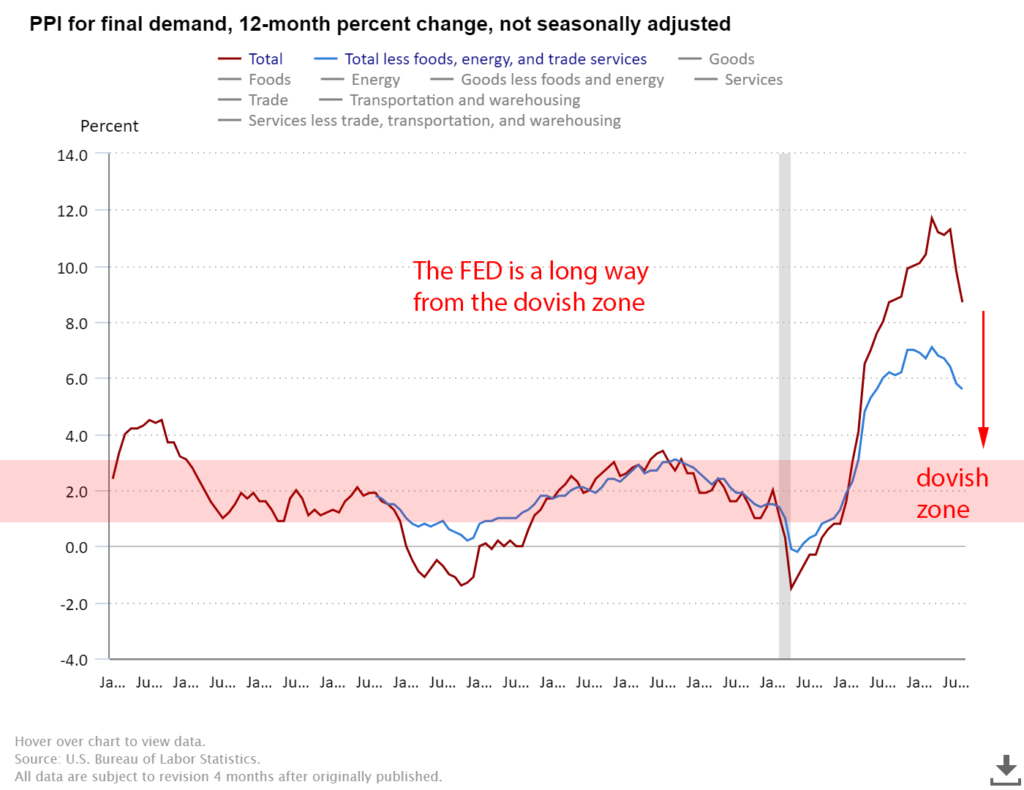

The chart below is the PPI core 12-month percent change and it’s a long way form the Fed’s target zone.

PPI – core Year over Year

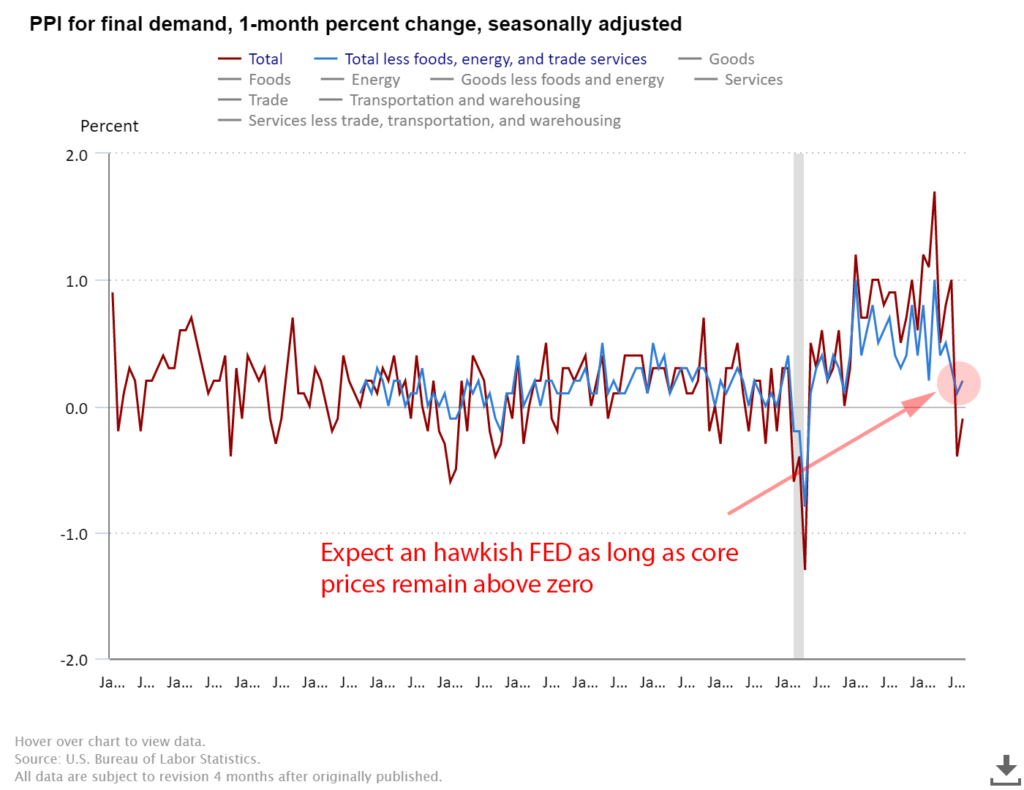

The chart below is the PPI core 1-month percent change and it’s above zero! At a minimum I’d like to see the monthly percent change dip below zero. To me, that would signal that inflation is under control.

PPI – core month over month

So far the data points towards a prolonged fight against inflation. It’s hard to argue otherwise given August’s core inflation uptick even as energy prices declined.

Trade update

A characteristic of bear markets is when the market opens up big and then sells off into the close. That’s exactly the price action today, both the SPX and NASDAQ are following this pattern. To me, this is confirmation my SPY short trade via SDS from yesterday is working.

Today I’m adding to SDS position at $45.84.

Details about yesterday’s trade can be found here.

Conclusion

Is inflation sticky?

In my opinion, core inflation is stubbornly high when I objectively look at the data. Going forward I think this means another 75 bps hike at the Sept 21st meeting next week. If that happens and oil prices trend lower we’ll have the ingredients for a possible turn in core prices. Until then, killing inflation is job numero uno at the Fed.

No rate cut bailouts for investors this time!

Long-term passive investors care less about short-term fluctuations in inflation. They invest at extraordinary low cost and hold the index long-term, knowing stocks increase in value regardless of shot-term influences.

Thanks for reading!

Trade and invest at your own risk. Trade your own view.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.