(600 words, ~4 minute read) It was tough to squeeze all the important moments, but I think it turned out okay.

Paid to wait. That’s the approach to start this year. A defensive approach due to tight monetary conditions and questionable future growth. It’s been a long time since investors could hide out in cash and earn a >4.5% yield! This is good news, you get paid to wait for quality opportunities.

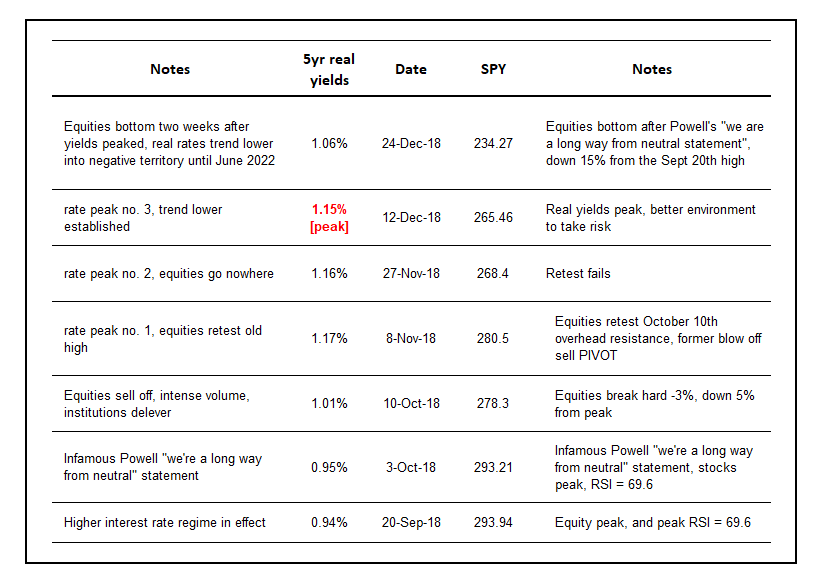

But first a story about the path of US 1month treasury rates during 2018 as yields, both real and nominal, were in restrictive territory. There are a few lessons to learn.

Let’s back up and look at bond yields from the rearview mirror. From there we can try to predict where yields might go in the future. US 1month yields previous high was 5.27% on February 21, 2007. The last time 1month yields traded above 4% was Halloween 2007. So, its been over 14 years since rates were above 4%. Wow! Today 1month yields are 4.59%.

Monetary policy is extraordinarily tight.

Back 14 years ago was the time of the great financial crisis and the collapse of the US real estate market. Confidence in all things financial hit an all time low and Central Banks had to bailout the economy. Stock crashed and yields plunged.

As a result, a fancy new zero interest rate policy regime (ZIRP) was born and stocks began an epic bull run lasting until October 2018. Before the bull run ended a tightening cycle was underway by the Fed lasting 40 months (3.3 years) from late 2016 to early 2019 lifting rates from the zero bound. US 1month rates peaked at 2.51% on March 21, 2019.

Equities peak before the end of an interest rate tightening cycle.

Rate hikes finally broke the stock market on October 10, 2018 as US 1month yields traded 2.18%, six months before J. Powell pivoted monetary policy towards being accommodative. Stocks and risk assets plunged as smart money took major risk off the table. The same day US inflation index 5yr TIPS peaked after three failed breakout attempts. From there real yields trended consistently back down to 0%. Stocks bottomed on December 24, 2018 declining ~20%.

Equities need lower yields to rally.

2018 Tightening Timeline

Final Thoughts – You get paid to Wait these days

In conclusion, credit tightening cycles are made up of a series of interest rate hikes with the goal of slowing economic growth and inflation. Looking at the 2018 credit cycle we can conclude that equities don’t like real rates above 1%. Also, equites peak before yields do. Remember equities lead the credit cycle. Today real rates are 1.36%. Financial conditions are tight.

What about today post FOMC?

Risk seems to be misplaced at the moment. We know growth is slowing in the US because of the credit tightening cycle, but the Chinese reopening narrative is a big driver of recent gains. Yesterdays FOMC was perceived as dovish, extending the January rally in risk assets. However, today’s follow-through is sus, just take a look at Alibaba down >3% at the open, or the weakness in commodities.

I think the wise move here is wait for NFP tomorrow, see how the market reacts, plan over the weekend and execute on Monday. Sometimes it’s best to let the dust settle before jumping in.

Thanks for reading!

By the way, everyone needs a financial plan, checkout this post and get started!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.