(491 words – 4 minute read)

With so many economic outcomes this year it makes managing investments particularly challenging. Usually, the decision tree consists of only a couple of branches, but his year we have 5 basic outcomes to consider. The direction is uncertain: up, down, or sideways. Who knows?

I think taking a probabilistic approach is a good idea as there are so many paths the economy could take this year. If you’re a poker player like I am, assigning probabilities to outcomes is a good way to come to a pragmatic decision. This comes particularly handy when determining an optimal asset allocation.

Just like watching poker on TV, where you can see the odds of winning change as the hand progresses. We can do the same with our economic forecasts. Act with conviction when odds are abnormally high and fold otherwise. Below is my updated probability distribution of possible economic outcomes for 2023.

2023 Economic Outcomes – first half

| Outcome | Description | Jan 1 | Feb 1 |

|---|---|---|---|

| No landing | Inflation stays sticks, growth is meh, employment stays strong | 5% | 10% |

| Soft landing | Inflation slowly returns to 2%, growth slows a bit, employment says strong | 40% | 40% |

| Mini recession | Inflation returns to 2%, growth slows, unemployment rate modestly rises | 40% | 35% |

| Hard landing | Inflation drops to 2%, growth materially slows, unemployment rate rises | 10% | 10% |

| Crash landing | Inflation collapses, growth drops off a cliff, unemployment surges | 5% | 5% |

Noticeable changes since January 1st

- the odds of a No landing jumped higher

- the odds of a recession ticked lower

This melds with the rally in risk assets to start the year. I wonder if the No landing outcomes deservers a higher weighting as I digest all last week’s data. Here’s a summary.

- FOMC portrayed by markets as dovish, risk assets rally

- ECB and BoE both hike by 50 bps, risk assets rally

- NFP/employment rock solid, historic tightness, risk assets sell off

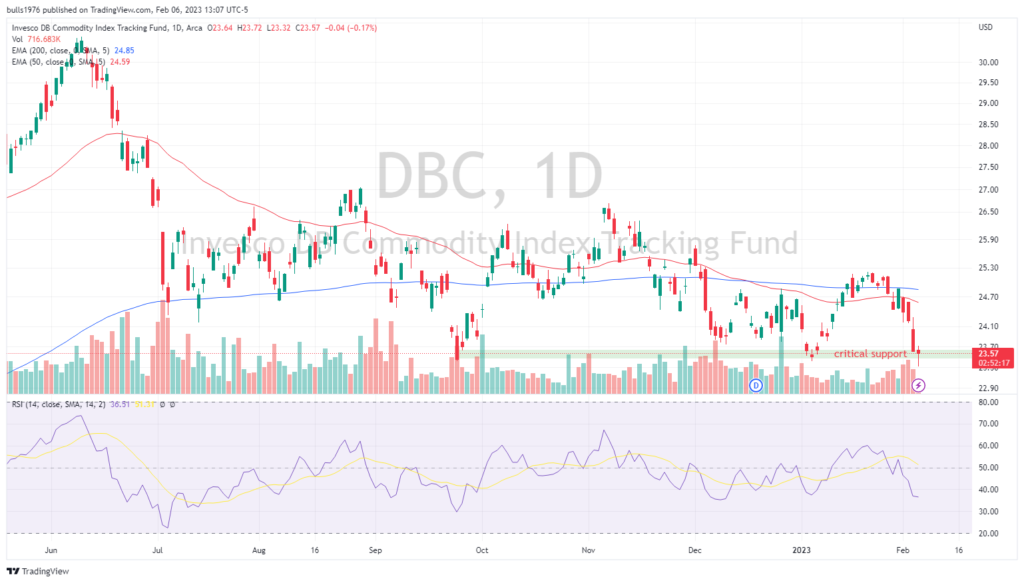

If the trend continues in hard data the recession odds should continue to weaken. However, to counter that opinion, a quick look at commodities says, “hey, wait a minute.” Right now support is holding, but if commodities break the odds of a mini recession go up.

DBC Commodity Index

Also Chinese equities, a big drive of this year’s rally in risk assets, seem to have lost their mojo. Ironically, they peaked Jan 27th, just before last week’s trifecta of FOMC, ECB/BoE, and NFP payrolls. If Chinese equities won’t play ball, it’s either because they stockpiled before the re-opening, or Chinese growth is a Q2 story. Regardless, continued strength is important to the soft landing outcome.

FXI – China Large Cap ETF

Final thoughts

To be sure, this year it’s extraordinarily tough to call the direction of the economy. To start the years odds have increased that we’ll avoid a recession, but recent progress could be undone if commodities and Chinese equities continue to show weakness. Continual monitoring of the probability distributions will likely become a common feature this year.

No changes to the asset allocation of our flagship ETF portfolio. Staying defensive for now.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, checkout this post.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.