(482 words – 4 minute read)

Will Chair J. Powell step up to the microphone and tell speculators that risky assets have no business trading at these elevated levels? I dunno, but it’s all that matters today.

Powell speaks at noon today, so be prepared for heighted volatility. I wonder if Powell changes his dovish tune from last Wednesday after the strong ISM data, or will he acknowledge the loosening of financial conditions since June last year. Certainly, it makes sense to hold off placing any bets until this event passes.

In the meantime, let’s review several key driver’s of this years monster January rally.

- Commodity prices are on a knife edge, key support holds for now.

- Weird signals out of China.

- Real rates respond to the uncertainty by tightening.

- Bond volatility rear its ugly head.

Commodities try to rally off key support level

As I mentioned in yesterday’s post Economic Outcomes, commodities look weak and heavy. If the critical support level fails, risk assets could be in trouble.

What happened to the China reopening trade?

Chinese equities are attempting to find a bottom. BIDU popped nicely this morning as they announced an AI GTP3 chat bot, but participation is not broad based.

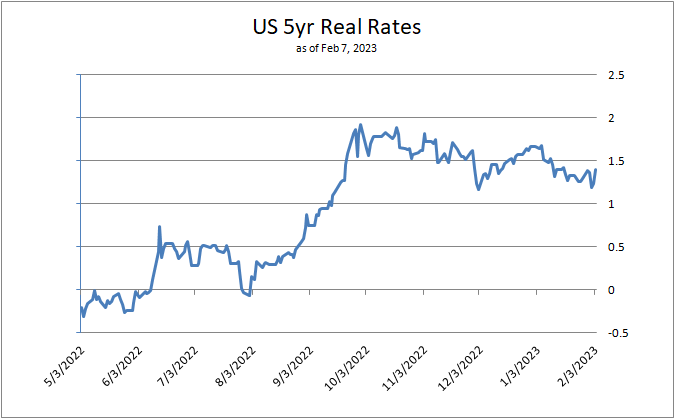

US 5yr Real Rates Bottoming?

Real rates may be rallying given today’s big jump indicating tightening financial conditions. If this trend continues risk assets should come under selling pressure.

Bond Volatility

I haven’t wrote much about bond volatility because rates were pinned to zero for a decade. But now, 1month t-bills yield greater than 4.5%! Therefore bond volatility is now super important. The key take away, is rising bond volatility is generally bad for stocks and risk assets. The chart below shows during October last year bond volatility peaked and stocks were able to find a bottom. Today, we could be in the early innings of another run up in bond volatility. Note the big spike today.

You can track bond volatility with the MOVE index.

MOVE INDEX – bond market volatility

Final Thoughts

With so many paths the economy could take this year, it’s difficult to determine is the rally in risk assets will continue. Yesterday I summarized the probability distribution of economic outcomes, and it makes sense to wait for more data before making any investments. All the mixed signals noted above make calling the direction of risk assets extraordinarily difficult this year.

The days of smooth sailing risk asset rallies are over.

Again, no changes to the asset allocation of our flagship ETF portfolio. Staying defensive for now.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, checkout this post.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.