Ultimate Market Update is your source for actionable investing information.

First, the objective of the Ultimate Market Update is provide you with a quick way to get the information you need. Second, I promise to not use any financial jargon. Finally, and most importantly, you will become a wiser investor.

With this in mind, you will find this update broken down into three sections. To start, we’ll cover the big three markets: f/x, bonds and stocks.

In reality, many events pop up that effect the markets. To be sure, if an event surfaces that could effect markets I will address it.

F/X

Foreign exchange markets are the biggest in the world. While this may be true, I like to think of a nation’s currency as its common stock. If the US dollar is rising, things are good. While the opposite is not a good sign. Straight forward, right?

Right now every country in the world is printing money like crazy. All in an attempt to battle the pandemic. In view of this fact, we can expect every nation’s currency to take a turn at a devaluation.

At the moment it’s the US dollar being devalued. Want proof? Check out the chart of the UUP. The UUP (US dollar index ETF) is in a downtrend.

In other words, if you live outside the United States and hold US dollar investments you are facing a major headwind.

Bonds

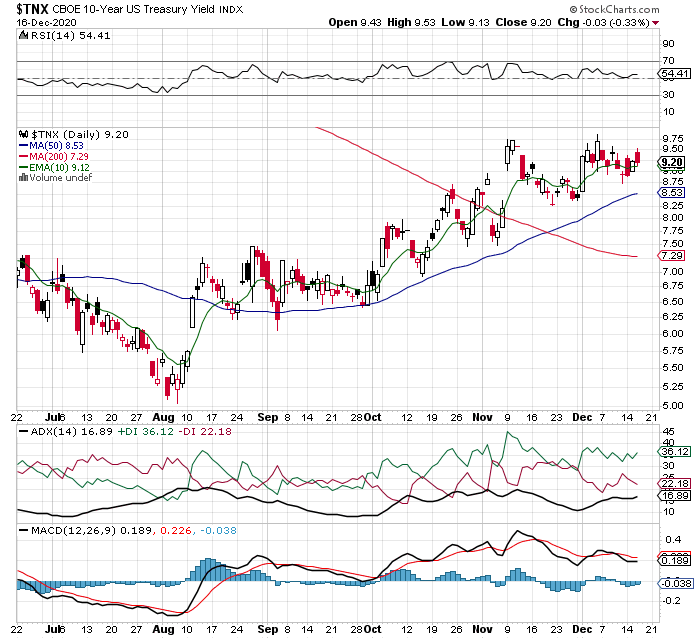

First thing to remember is that a bond’s price has an inverse relationship to its yield, or interest rate.

Second thing to remember is the Federal Reserve, and all global central banks, have pinned interest rates to ZERO.

As a result, investors are cashing out and moving their capital to the stock market. Why? Because the simple fact is the US 10-year treasury is yielding less than 1%. Indeed, investors cannot outrun inflation investing in the bond market.

I call this phenomenon the Great Interest Rate Differential. To be sure, investors will continue to leave the bond market in search of better returns in the stock market.

Stocks

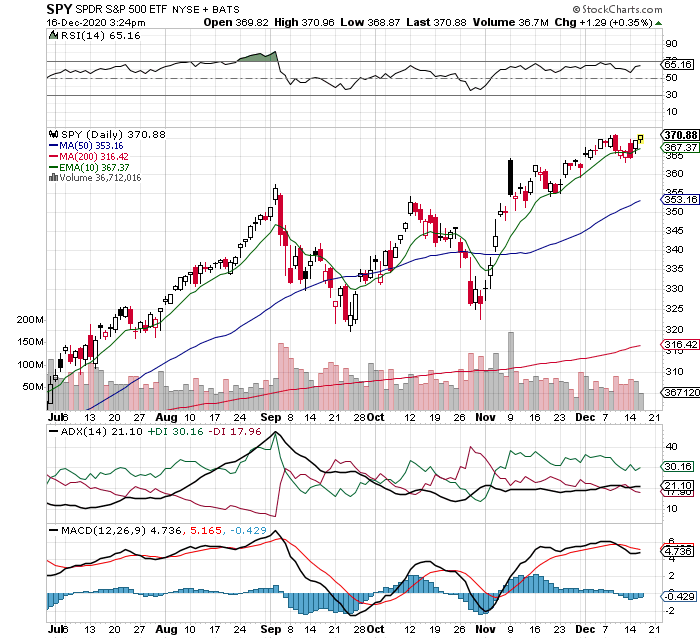

Why is the stock market hitting all time highs during a global pandemic? Have you asked yourself that question?

I have a thousand times. And surprisingly, the answer is straight forward.

The thing is, it always comes down to inflation. To become a successful investor you must outrun inflation over the long term. Let’s circle back to the US 10-year treasury yield of 0.92%. If inflation is say 2%, you have a guaranteed lose of more than 1%. And that’s over ten years!

Perhaps the fact that “money” pays zero interest is the reason why stocks are in the biggest bull market in history.

Just take a look at the S&P 500 index below and ask yourself, “Am I missing out?”.

Conclusion

To be sure, as long as interest rates are forced to zero by global central banks, investor will continue to pile into the stock market.

Of course, there will be bumps along the way. But, in the end, stock are the only investment (at the moment) that have a legit chance of beating inflation.

Long live the biggest bull market in history.

DISCLAIMER: Content provided in this article is intended for informational purposes only and should not be construed as legal and/or investment advice and should not be relied upon or acted upon without retaining counsel to provide specific legal and/or investment advice based upon your particular situation, jurisdiction and circumstances. No duties are assumed, intended or created by this communication.

© mikehoganonline.com, All Rights Reserved