Is it time to turn up the risk needle?

Welcome to Alpha Dawg! My almost daily note about global self-directed investing and trading. You get all my investing ideas, analysis, and risk management techniques. I hope you enjoy the content. I aim for about 500 words or a 2 minute read.

Alpha – noun

abnormal investing returns, the edge of a strategy in excess of market returns

Often I miss the first signs of a shift in sentiment and economic indicators. To be sure, I definitely missed the “risk on” flag on July 27th. That’s part of trading, but what’s more important is swinging at the second or third pitch.

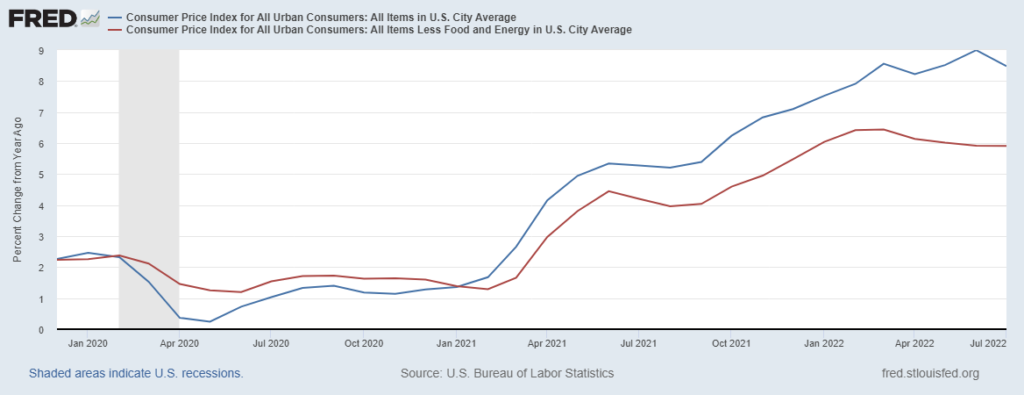

Looking back the August 5th NFP print was the second flag to a bullish, risk on mindset among investors. Yesterday’s CPI number follow suit, being better than expected.

New market narrative

So, the market now thinks the FED will turn into doves as early as September, maybe we get a 50bps hike instead of 75. I’m not so sure, but I’ve been bearish and wrong and tired of red on my P/L. Sticking with a stale narrative is a good way to lose money.

The economic calendar is light for the next 5 weeks. The next major economic event is Jackson Hole on August 27th with no rate decision. We’ll have to wait until September 20-21st, to get the next rate hike. This leaves significant time for the rally to run. Expect many out-of-office emails and travelling families as equites melt higher on weak summer volume.

One tactical setup I like is a rally into the Sept 20th Fed meeting, followed by weakness into the US mid-term elections.

In this scenario I expect both the SPY and the energy sector to rally in tandem for the next several weeks. The problem is if energy prices start trending higher the probability of CPI ticking higher on September 13th (August CPI) is meaningful. If this proves correct, it’s likely the equity rally stalls and the dovish rate narrative dies on the vine.

Tactical Trades

The risk is pretty simple to manage. I going to trade this rally as a double barrel long shot.

- Buy SPY on August 11th ($420.00) with a stop at $406.74.

- Buy DVN on August 11th ($64.45) with a stop at $59.98.

If I’m right I’ll adjust the stop higher as the rally matures. This way if sentiment turns bearish I’ll get stopped out just as the anticipated weakness shows up in September.

Key Takeaways:

- oil prices are in the CPI drivers seat

- light economic calendar until Sept 20th

- bullish narrative shift underway

Bullish narrative shift(s) are difficult to accept if you’re a permabear. To trade and invest successfully you have to have an open mind and constantly question your reasoning. Nothing stays static.

If you’re interested in risk management, checkout this post where I tried to jump on the energy bull market right at the top and see how the stop loss saved my ass.

Thanks for reading!

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content. Trade and invest at your own risk. Trade your own view.