finding balance can be tough

(385 words – 3 min read)

Big news this week as two new positions are added to the Alpha portfolio.

Key economic stats

- US 10yr treasury yields shoot to over 4%

- ISM manufacturing PMIs surprise to the upside

- weekly US jobless claims show a strong labor market

- No FEAR in the market as the VIX is under 20

It all comes back to jobs, if you got one all is good. On the other hand J. Powell is looking for rising unemployment to declare victory over inflation. So, it’s safe to assume that a tighter for longer rate regime is expected. This doesn’t help the forecast from my quadrant analysis, which points to a defensive approach to risk management.

Last week two new positions were added to the Alpha Portfolio, 1) Alibaba and 2) MongoDB.

The reasoning behind buying BABA is largely due to the China reopening story. The recent 25% sell off severed up a great buying opportunity. The stock is currently down 71% from its all time high.

MongoDB is a technology play. The company’s focus is NoSQL databases which work great in the internet/e-commerce driven economy. With more companies looking to enhance their online presence, database flexibility is key and MongoDB is the industry leader. The stock is down >60% from its all time high.

To be sure, bear markets can be brutal.

View portfolio transactions here.

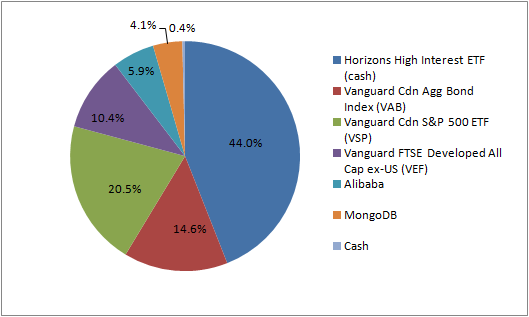

Alpha Portfolio Asset Allocation

Final Thoughts

I get the feeling lately I’ve been too bearish on risk assets in general. Last week saw an epic rise in US treasury yields along with bullish PMIs, the VIX collapsed and equities held their ground.

I’ve been patiently waiting for an opportunity and watching the Passive 60/40 portfolio outperform. Indeed, this is a classic situation active managers often find themselves: caught in a defensive mindset while risk assets rally to the moon. A sure way for a PM to lose their job!

Two additions to the Alpha Portfolio, you can view the changes to the asset allocation of our flagship ALPHA portfolio here.

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, if you don’t already have one.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.