Federal Budget 2022 in Canada left investors less than thrilled.

The minority Liberal Party of Canada released their 2022 budget last week. To recap, government spending is set to top $31 billion over the next 5 years. This whopping bill represents about 1%-2% of GDP.

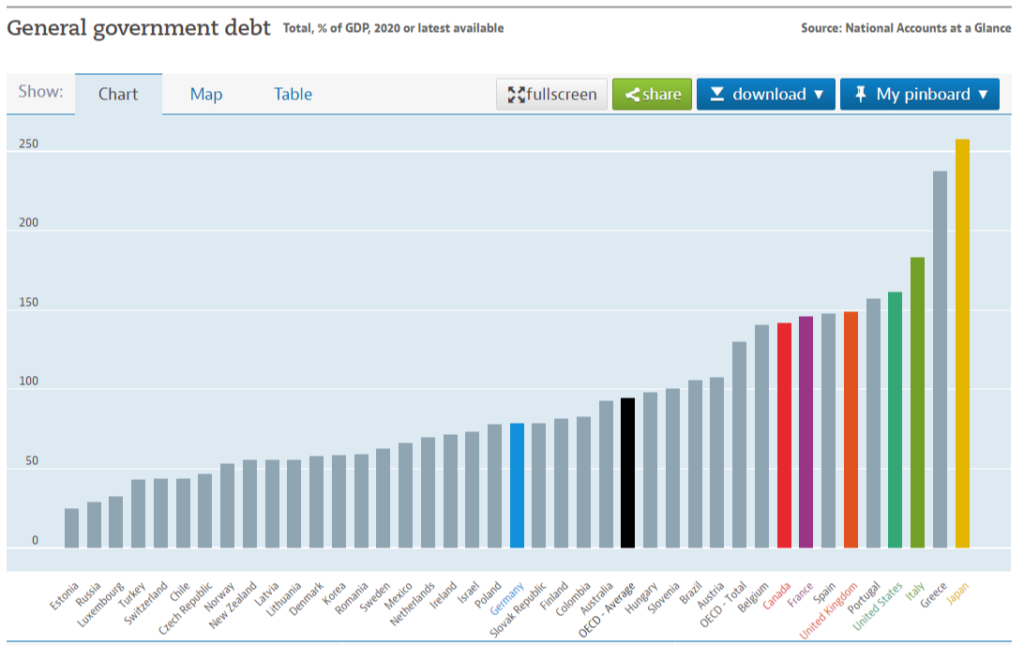

I can’t help but wonder which country is next to join the >150% club? You never know, Trudeau might give Macron a run for his (or France’s) money!

Spending Highlights

- $5.3 billion – Dental Care Program

- $8 billion – National Defense – large chunk earmarked for Ukraine

- Housing Affordability – ban foreign purchases of residential property for 2 years – create the First Home Savings Account (hybrid TFSA, $40k cap)

- Clean energy – 30% tax credit to businesses focusing on clean energy – create the Canadian Growth Fund to attract new investment in technology

Bank/Life Co. New Taxation Measures

- Increase corporate tax rate by 1.5%, from 15% to 16.5%

- One-time Canada Recovery Dividend – 15% tax on earnings > $1 billion for the 2021 tax year

- “Looking into” a wealth tax – details to be released later in 2022

Conclusion

To put it bluntly, investor’s had to pinch their nose to get through this budget. Indeed, the Trudeau government delivered on their campaign promises. The NDP got a national dental program, which is a good thing. Of course, housing affordability will continue to be a problem even with the budget measures introduced, largely driven by short supply and way too low interest rates.

Big banks and life insurance companies, a favorite target of Trudeau, are now face rising costs thanks to higher taxes. Unfortunately for consumers, financial institutions wrote the play book on passing costs onto customers. In the end, taxing financials leads to higher inflation.

All in all, this budget was not investor friendly. The Canada Recovery Dividend (or more accurately called a tax) is nothing more than a opportunistic tax on Canadian financial institutions, the fabric of Canada. To be sure, Canada’s energy sector is now in Trudeau’s sights thanks to the Ukraine war. In light of sky high oil prices, the energy sector likely is facing the same situation as the financials. Higher taxes and more inflation down the road.

–

–

DISCLAIMER: Content provided in this document is for your informational and entertainment purposes only. This document is not a solicitation for an investment, is not comprehensive, and should not for the basis for any investment decision. This document is not an offer to sell or a solicitation of an offer to buy any securities, commodities, or financial instruments, and my not be relied upon in connection with the purchase and sale of any instruments or interests in investment vehicles. This document should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this document.

Mikehoganonline (“MHO”) strongly suggests that you obtain independent advice in relation to any investment, and with respect to any financial, legal, tax, accounting or regulatory issues resulting form such an investment. In addition, because this document is only a high-level summary: it does not contain all materials terms pertinent to an investment decision. This document should not form the basis for any investment decision. Information contained in this document has been obtained from sources that MHO believes to be reliable, however MHO make no assurance or guarantee that such information is true and/or accurate, and MHO expressly disclaims liability arising form the use of information contained herein.

This document contains statements of opinion. These statements of opinion include, but are not limited to, MHO’s analysis and views with respect to: digital assets, projected inflation, macroeconomic policy, the market adoption of digital assets (including Bitcoin and Ethereum, and Blockchain), technical and fundamental analysis, financial planning, and the market in general. Statements of opinion herein have been formulated using MHO’s experience, research, and/or analysis, however, such statements also contain elements of subjectivity and are often subjective in nature. In addition, when conducting the analyses on which it bases statements of opinion, MHO has incorporated assumptions, which in some cases may prove to be inaccurate in the future, including in certain material aspects. These analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing in this documents represents a guarantee of any future outcome, or any representation or warranty as to future performance of any financial instruments, credit, currency rate, digital currency or other market or economic measure. Information provided reflects MHO’s views as of the date of this document and are subject to change without notice. MHO is under no obligation to update this document, notify any recipients, or re-publish the content contained herein in the event that nay factual assertions, assumptions, forward-looking statements, or opinions are subsequently shown to be inaccurate.

© 2022 mikehoganonline.com, All Rights Reserved