Markets in search of direction is usually a time when patience is warranted. To be sure, January 2022 was a tough month for risky assets. Risk premium was wiped from technology stocks at a breath taking pace. For one thing, from the rubble new leaders and new risks emerge.

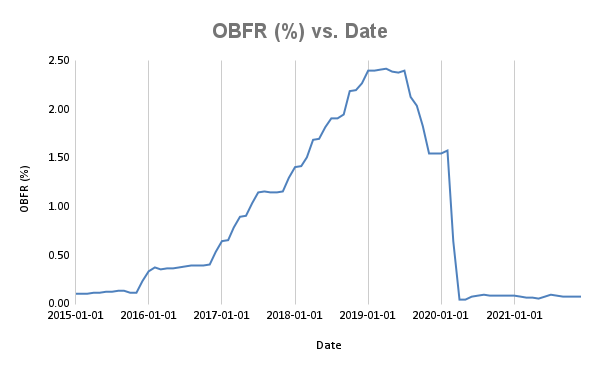

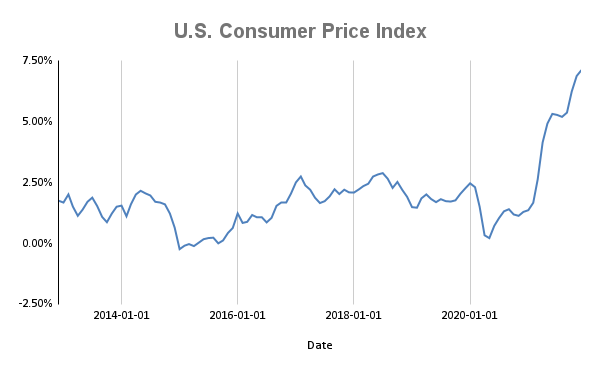

The challenge now is balancing the transition from ultra loose monetary policy to a tightening regime. Unquestionably, this time we are in a different pickle. Looking back at the last tightening cycle there are two big differences. First, is the duration of the tightening cycle. Second, is the inflation level.

The last tightening cycle started January 2016 and lasted until January 2019, a duration of 36 months for a total of 9 hikes. At that time, annual inflation was running at 1.24%. Today the setup is very different, as annual inflation is running at a prickly ~7.12%. To make matters worse, the Fed plans to jam 5-6 hikes in 12 months. Yikes!

Sometimes is helps to list market risk factors to gain better perspective. Unfortunately, this list is ugly and long.

Market Risk Summary:

- Inconsistent Fed monetary guidance, we don’t know if we’re getting 25 of 50 bps hikes. Size and timing is anyone’s guess.

- Raging inflation and a dovish Fed (Wait, wut?).

- Supply chain disruptions, entrenched or resolving?

- Tight labor supply leading to rising wages (aka more inflation).

- Recent spat of terrible economic data (is a recession looming?).

- Approaching the fiscal cliff as stimulus ends.

- Raging energy sector bull market fueling inflation.

Conclusion

In the end, we have an unknown road ahead when it comes to monetary policy. The list of risks facing investors in unprecedented in my view. Indeed, the combination of raising interest rates while the economy slows is a recipe for disaster. Also, is the economy headed for recession, or is Omicron the cause of recent weak economic data? At this point, it’s likely investors will be in “sell the rally mode” until we have a better picture on two fronts: 1) clearer guidance from the Fed and 2) outlook for the economy.

All things considered, now is not the time to ratchet up portfolio risk.

–

Here’s another post you might like –>

–

DISCLAIMER: Content provided in this document is for your informational and entertainment purposes only. This document is not a solicitation for an investment, is not comprehensive, and should not for the basis for any investment decision. This document is not an offer to sell or a solicitation of an offer to buy any securities, commodities, or financial instruments, and my not be relied upon in connection with the purchase and sale of any instruments or interests in investment vehicles. This document should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this document.

Mikehoganonline (“MHO”) strongly suggests that you obtain independent advice in relation to any investment, and with respect to any financial, legal, tax, accounting or regulatory issues resulting form such an investment. In addition, because this document is only a high-level summary: it does not contain all materials terms pertinent to an investment decision. This document should not form the basis for any investment decision. Information contained in this document has been obtained from sources that MHO believes to be reliable, however MHO make no assurance or guarantee that such information is true and/or accurate, and MHO expressly disclaims liability arising form the use of information contained herein.

This document contains statements of opinion. These statements of opinion include, but are not limited to, MHO’s analysis and views with respect to: digital assets, projected inflation, macroeconomic policy, the market adoption of digital assets (including Bitcoin and Ethereum, and Blockchain), technical and fundamental analysis, financial planning, and the market in general. Statements of opinion herein have been formulated using MHO’s experience, research, and/or analysis, however, such statements also contain elements of subjectivity and are often subjective in nature. In addition, when conducting the analyses on which it bases statements of opinion, MHO has incorporated assumptions, which in some cases may prove to be inaccurate in the future, including in certain material aspects. These analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing in this documents represents a guarantee of any future outcome, or any representation or warranty as to future performance of any financial instruments, credit, currency rate, digital currency or other market or economic measure. Information provided reflects MHO’s views as of the date of this document and are subject to change without notice. MHO is under no obligation to update this document, notify any recipients, or re-publish the content contained herein in the event that nay factual assertions, assumptions, forward-looking statements, or opinions are subsequently shown to be inaccurate.

© 2022 mikehoganonline.com, All Rights Reserved