Sector rotation trades tell me that the bull market is alive and well. Despite what Financial TV outlets like CNBC claim.

Today, CNBC is trying to talk down the stock market and cool things off with coverage of Treasury Secretary Yellen’s comments. Sure enough, the big index etfs like SPY and QQQ are getting hammered. Mission accomplished. But, take a closer look and you’d notice that financials and energy are catching a bid.

Frankly, it’s so obvious these days when sector rotation trades come into play. Sometimes, these trades last for months, even quarters. So, catching them early can pay off big time.

Back in March I posted an article on this same sector rotation trade. Check it out here =>

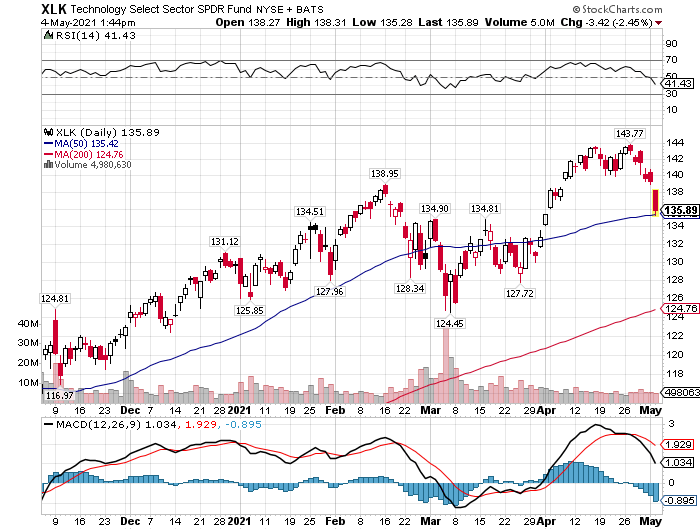

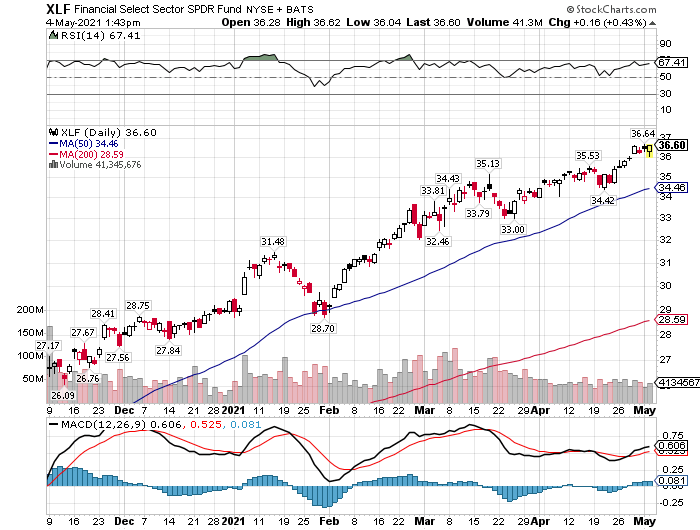

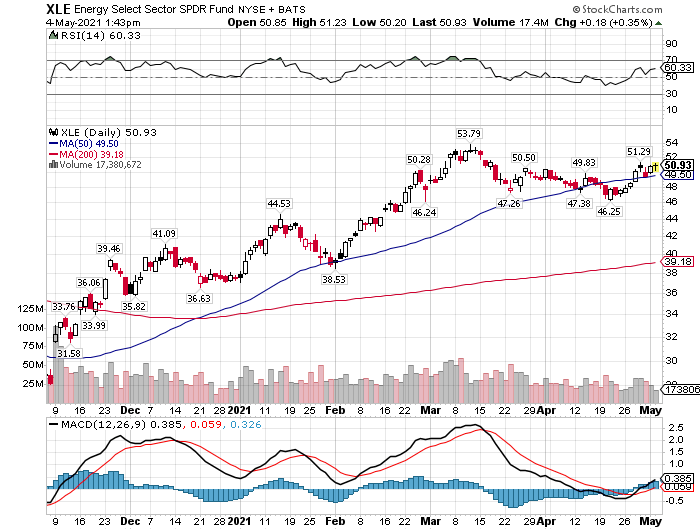

To illustrate, let’s have a look at three sectors: technology, financials and energy.

Take note of how money is leaving the technology sector and plowing its way into financials and energy.

traders unloading technology shares

and then buying financial stocks

and buying more energy stocks

Obviously, Treasury Secretary Janet Yellen’s comments today are intended to cool things off. On the surface the big etfs like SPY and QQQ, have fallen in line. But, hedge funds are smarter than that. They know stocks are heading higher. So, under the cover of Yellen’s comments, hedge funds and smart money are quietly buying financials and energy stocks.

Conclusion

As a trader, spotting sector rotation trades is an important skill. Surely, it takes time and experience to develop the confidence to trade them. But, in the end, you’ll find them useful and profitable trading strategy used by hedge funds and traders.

Are you looking for stocks flying under the radar? If so, click here =>

DISCLAIMER: Content provided in this article is for informational and entertainment purposes only. This article is not legal and/or investment advice. This article should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this communication.

© 2021 mikehoganonline.com, All Rights Reserved