Just a quick note to highlight the sector rotation picking up speed as markets trade today.

Being able to spot sector rotation trades is a good way to make money buying stocks.

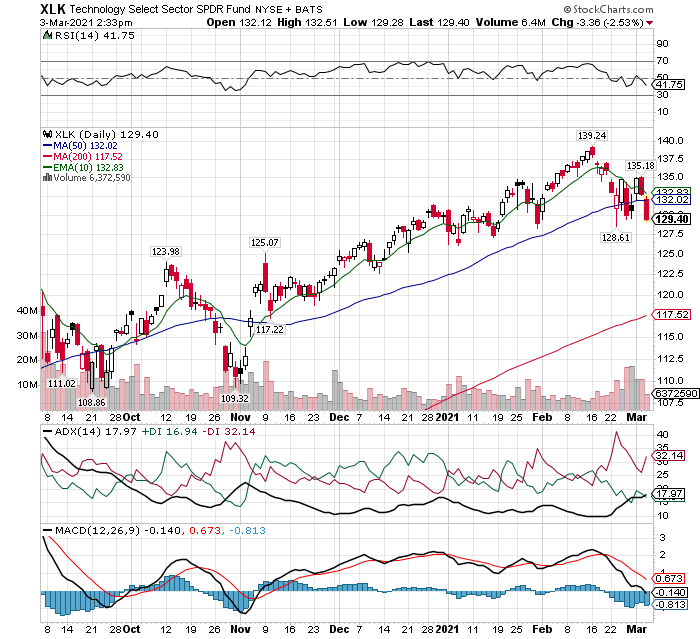

In light of the rally in treasury yields, technology stocks have succumb to heavy selling today. Also, stock eft SPY (spy – nyse) is drifting down to its 50 day moving average. Clearly, investors are cautious.

Since technical analysis is a useful tool, you can clearly see the breakdown below the 50 day moving average. The chart is no longer bullish.

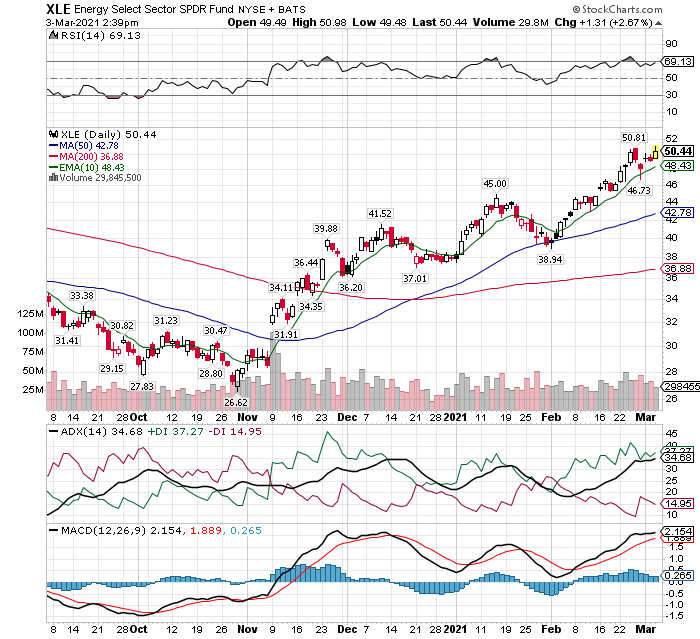

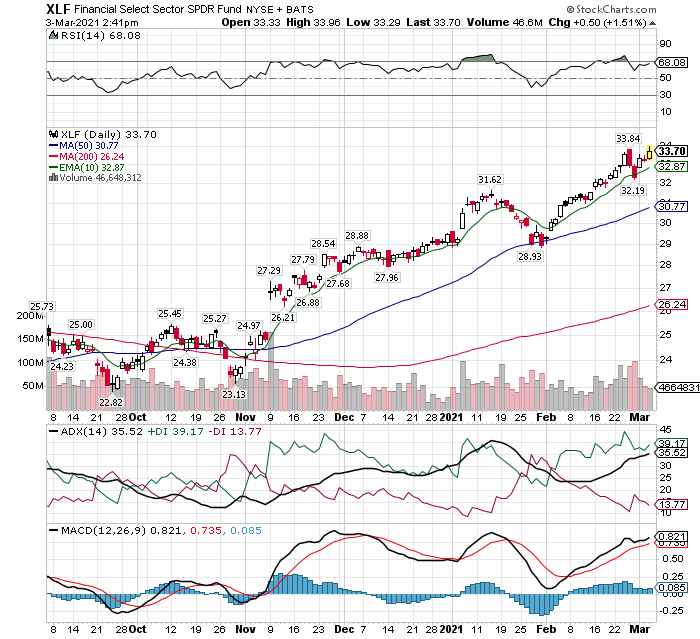

By the same token energy and financials have been stubbornly bullish. Even as treasury yields rise.

In contrast, these two etf charts are very bullish.

Although this may be true its difficult to ignore the fact that stocks now yield about the same as treasuries.

Surprised to learn that? I was.

Conclusion

To conclude, keep an eye on treasury yields. This very important. In particular watch the 1.5% level. With any luck, yields will stabilize at that level. Otherwise stocks could be in some trouble.

In fact, the US treasury market is the only market that truly matters. If you need a quick recap why…. check out this post.

But, for now energy etf xle looks to have room to run higher. Surely, the sector rotation picking up speed will continue.

Why? Because interest rates matter. Learn more here.