(580 words, ~4 minute read)

Statistical error? The NFP (non-farm payroll data) data release blew away economist estimates making the entire series a joke today. Seriously, economists consensus expectations was for +188k jobs created in January, but the data came in at +517k. On Wednesday the FOMC talked about the effect of recent rate hikes on the labor market’s strength. Well, today the disconnect grew and the market is going to wonder if the Fed took their foot off the brakes too early.

The Fed will continue to hike rates until the weakness appears in the labor market.

US Treasuries 5yr TIPS (inflation indexed)

The short-term range to keep an eye on is 1.16%/1.68%. Let me explain why. If real yields drop below 1.16% it tells the market financial conditions have materially loosened and equities and risk assets should rally hard. On the flip side, if real yields rise above 1.68% we can logically conclude conditions have tightened quite a bit. Under this scenario stocks and risk assets will have a tough time. Of course, if we stay range bound between 1.16/1.68 the soft-landing / China reopening rally probably still has legs but the nitro is tank is empty.

US real yields are a critical data input into our Quadrant Asset Allocation Model which helps determine the stance of monetary policy. Today 5yr real yields printed 1.19%, awfully close the taking out the bottom of the range. Something to watch closely going forward.

China Reopening and the soft landing narrative

Two main factors were behind January’s monster rally in risk assets. First, the expectation that the Fed will cut rates later this year as evidenced by the inversion of longer duration treasuries. The longer the inversion exists the more the market thinks the Fed will loosen financial conditions. Second, recently China dropping its strict Covid-19 restrictions leading a massive flow into Chinese equities. Together these two forces drove the rally in risk assets this year.

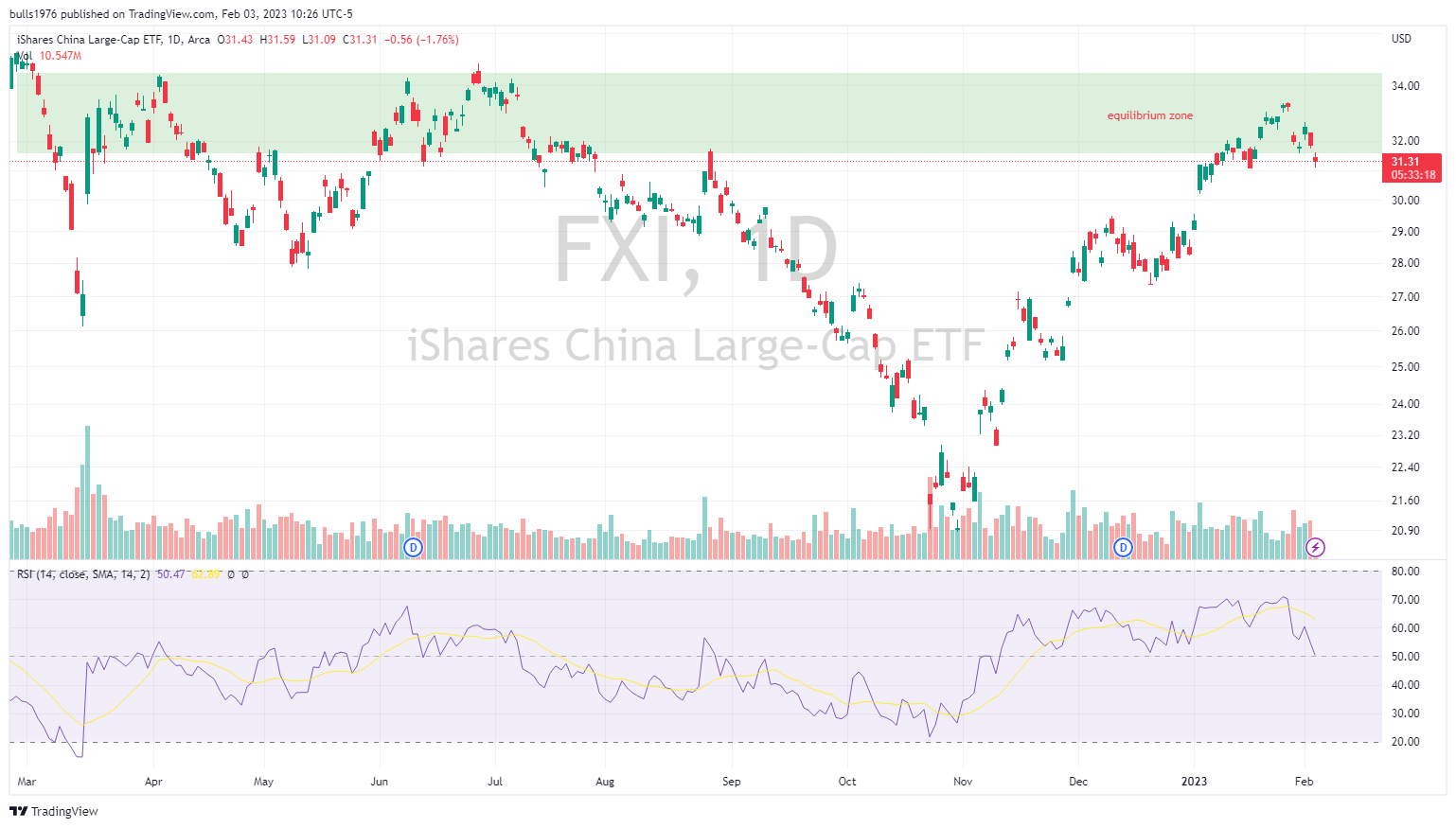

Today post FOMCE and NFP Chinese equities have struggled big time. the FXI China ETF dropped out of its equilibrium zone today. Further weakness could be a tell that the soft landing narrative is losing it strength. In other words, don’t chase equites here.

Final Thoughts

In the final analysis, this week was one of the busiest on record with FOMC, ECB, BoE and NFP all now in the past. A mixed bag of market reaction to a dovish Fed, hawkish ECB/BoE and finally a sizzling red hot US labor market. A ton of noise in the markets right now. I think next week’s response/reaction will be useful but not this week’s volatility.

The NFP release was one for the books. Truly and epic miss.

Weakness in Chinese equities has our attention and will likely provide the direction for risk assets shot-term. Commodities look weak as well.

For now, our asset allocation remains defensive with an overweight position in short-term gov’t bonds. However, we are actively looking for opportunities to deploy cash. By the way, 1month yields are above 4.5%. Juicy!

Thanks for reading!

Don’t pass up the opportunity to start a financial plan, checkout this post.

Disclaimer: The content on this webpage is intended for informational and educational purposes only. No content on this webpage is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons using the information in this educational content.

Invest at your own risk. Trade your own view. Do your own due diligence.