The Ultimate Market Update Ep2 is your source for actionable market information.

As always, the objective of the Ultimate Market Update is to give you market information as quick as possible. Also, I will not use any Wall Street jargon. If I do, please feel free to call me out! Finally, my goal is to help you become a successful investor.

With this in mind, you will find this update broken down into three markets: f/x, bonds and stocks.

Indeed, markets change quickly. So, you will likely find that my opinion changes often. You might think I’m being indecisive, but I’m not. Actually, I learned a long time ago to be flexible, especially when money is one the line.

The Cardinal Sin of any investor is riding a losing position all the way down!

F/X

Foreign exchange markets are the biggest in the world. The US dollar is the world’s reserve currency and the most popular.

However, since the pandemic hit, the US dollar has been in a downward spiral. Indeed, this will help US exporters, but foreign products keep getting more expensive. Inflation is bubbling under the surface.

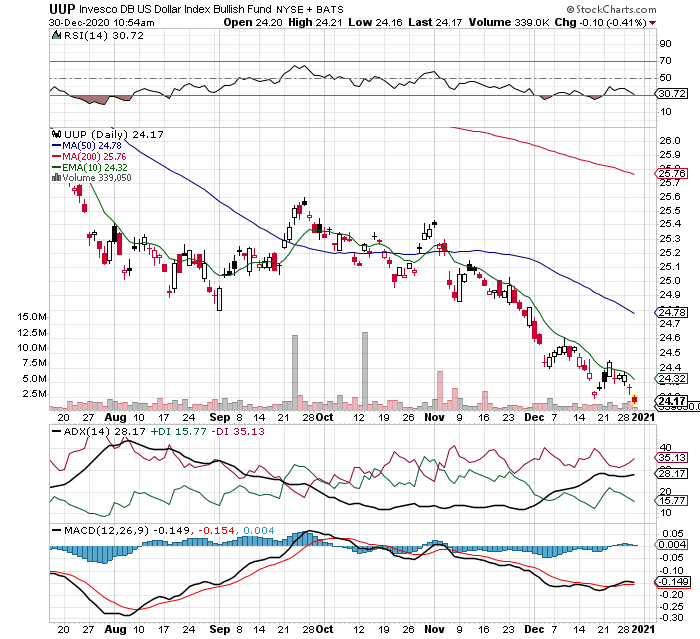

The UUP chart (US dollar index) below clearly illustrates the decline in the US dollar.

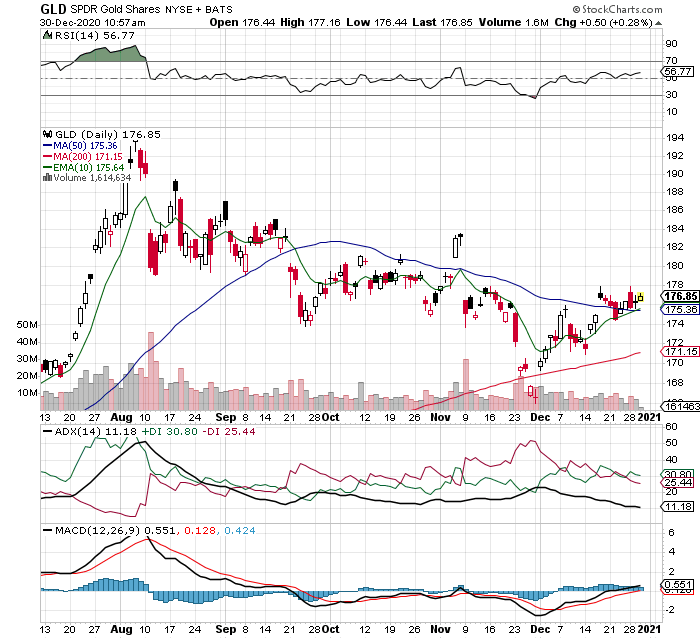

On the other hand, what about gold? Wall Street loves to parade around the idea that the US dollar and gold are inversely related, meaning they move in opposite directions.

But is this relationship true? Well, let’s look at the gold chart.

In reality, over the past six months we’ve seen a strong correlation since August, but since December the opposite is true. In the end, the “inverse” relationship between the US dollar and gold is sometimes true, but never cast in stone.

Bonds

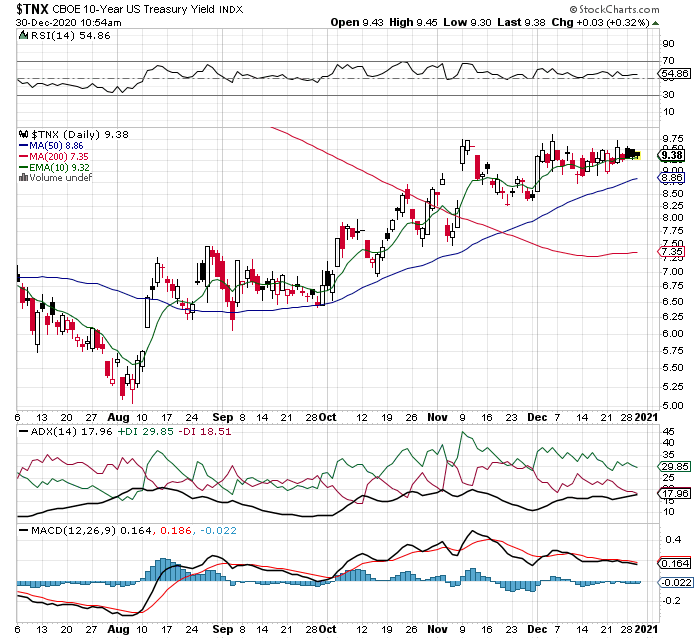

First a quick recap, a bond’s price is inversely related to its yield, or interest rate. This relationship is certain, not like the casual relationship between the US dollar and gold discussed above.

Global central banks have pinned Interest rates to zero for the foreseeable future. Moving forward, we can assume that these policies will not be changing anytime soon. And we can act on this information.

As a result, investing in the 10 year US treasury will result in a return less than the rate of inflation.

Bottom line, investor’s cannot get out of the bond market fast enough. I call this phenomenon the Great Interest Rate Differential. To be sure, investor’s will trample each other heading for the exits.

Stocks

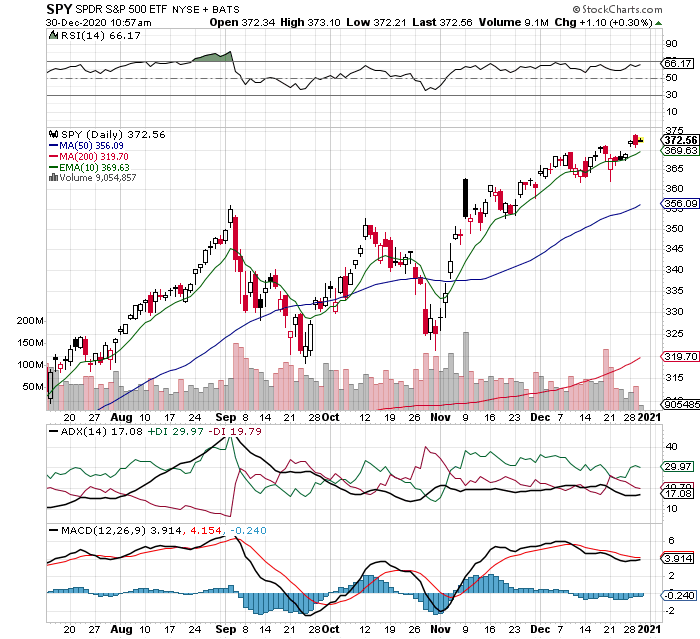

Have you ever wondered why the stock market keeps setting all time highs? Even during a global pandemic.

Well, you’re not alone.

The good news is the answer is straight forward.

The thing is it always comes down to inflation. If the interest rate is artificially set to zero, the biggest stock bull market in history will continue.

Take a moment and checkout the chart of the S&P 500 stock index.

Are you missing out? Are you sitting on the sidelines as stocks continue to soar? If so, ask yourself how can an investor survive when interest rates are set to zero?

Conclusion – Ultimate Market Update Ep2

Obviously, zero interest rates are a disaster for the bond market. But the good news is the Federal Reserve is prepared to buy any bond at any price. As a result, investor’s have a window to exit the bond market at a great price.

For sure, this is what’s happening. Money is leaving the bond market for the stock market. Stocks offer a better return and a decent chance of beating inflation. While the 10 year US treasury is a loser after inflation. This is what I call the Great Interest Rate Differential. For this reason, the stock bull market is far from over.

Be sure to check out episode 1 which can be found here.

Are you looking for a charting service?

If you are, checkout stockcharts.com. Their free service is good and contains all you need to get started. Regardless if you are new or a seasoned pro.

DISCLAIMER: Content provided in this article is intended for informational purposes only and should not be construed as legal and/or investment advice and should not be relied upon or acted upon without retaining counsel to provide specific legal and/or investment advice based upon your particular situation, jurisdiction and circumstances. No duties are assumed, intended or created by this communication.

© mikehoganonline.com, All Rights Reserved