Why the Bank of Canada did not raise interest rates today? A question hotly debated.

To summarize the current narrative, investors believe global Central Banks are behind the curve fighting inflation. Meaning, the time to fight inflation is now not later in March. The inflation hawks were disappointed today, as market probability suggested a 70% chance of a rate. No dice.

On the flip side, investors can shelve USDCAD interest rate differentials until March, when rates lift off from zero. For sure, as long as oil’s rally continues, the currency pair should remain range bound in the short term.

Clearly, the Federal Reserve and Bank of Canada are on the same page. They’re not in a hurry to raise interest rates. I see a coordinated policy towards the transition from loose to tight monetary policy. So far, markets have responded positively, but tomorrow we get the Fed’s decision and press conference. Powell will have to defend continued asset purchases under QE, there is a chance he could say something he shouldn’t.

What worries me is a policy error by the Fed. I distinctly remember Powell’s statement late 2018, “we’re a long way from neutral.” And the following stock price collapse into year end. Policy error is a real risk to be aware of and monitor closely.

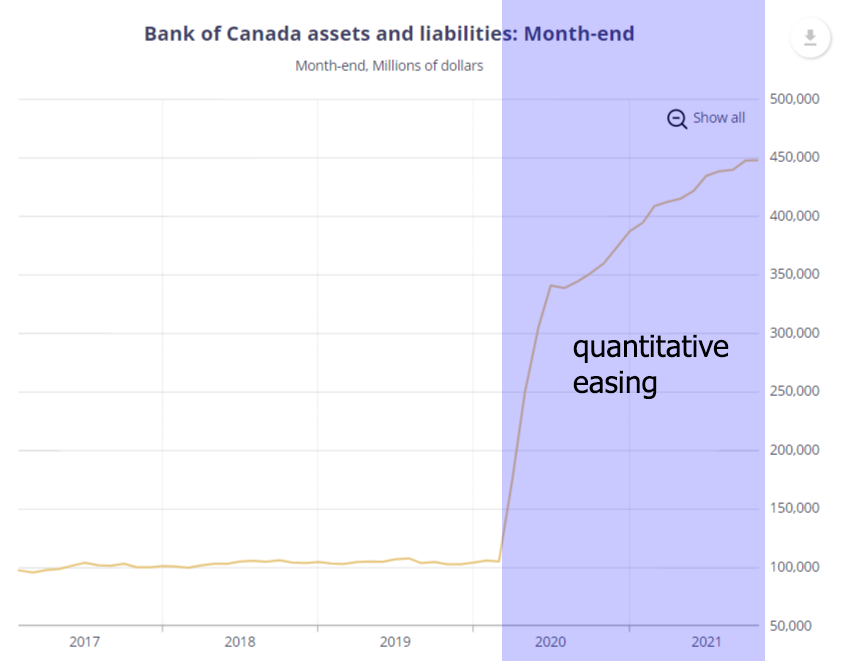

The chart below illustrates the size of BofC asset purchases under QE. Indeed, the BoC purchased about $320 billion worth of government bonds during the pandemic. Now the challenge becomes bleeding these assets off the balance sheet. A tall task to say the least.

Conclusion

In the final analysis, Central Bank policy is coordinated at the moment. More importantly, the Fed needs to end Quantitative Easing, which is widely expected to happen by March. Assuming no surprises, interest rates will start to rise in March, on pace for 4 hikes this year. Expect a 1% to 1.25% bank rate by the end of 2022, both here is Canada and the US.

–

Definition of a fear trade –>

–

DISCLAIMER: Content provided in this document is for your informational and entertainment purposes only. This document is not a solicitation for an investment, is not comprehensive, and should not for the basis for any investment decision. This document is not an offer to sell or a solicitation of an offer to buy any securities, commodities, or financial instruments, and my not be relied upon in connection with the purchase and sale of any instruments or interests in investment vehicles. This document should not replace professional investment advice based upon your particular situation. Duties are not assumed, intended or created by this document.

Mikehoganonline (“MHO”) strongly suggests that you obtain independent advice in relation to any investment, and with respect to any financial, legal, tax, accounting or regulatory issues resulting form such an investment. In addition, because this document is only a high-level summary: it does not contain all materials terms pertinent to an investment decision. This document should not form the basis for any investment decision. Information contained in this document has been obtained from sources that MHO believes to be reliable, however MHO make no assurance or guarantee that such information is true and/or accurate, and MHO expressly disclaims liability arising form the use of information contained herein.

This document contains statements of opinion. These statements of opinion include, but are not limited to, MHO’s analysis and views with respect to: digital assets, projected inflation, macroeconomic policy, the market adoption of digital assets (including Bitcoin and Ethereum, and Blockchain), technical and fundamental analysis, financial planning, and the market in general. Statements of opinion herein have been formulated using MHO’s experience, research, and/or analysis, however, such statements also contain elements of subjectivity and are often subjective in nature. In addition, when conducting the analyses on which it bases statements of opinion, MHO has incorporated assumptions, which in some cases may prove to be inaccurate in the future, including in certain material aspects. These analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing in this documents represents a guarantee of any future outcome, or any representation or warranty as to future performance of any financial instruments, credit, currency rate, digital currency or other market or economic measure. Information provided reflects MHO’s views as of the date of this document and are subject to change without notice. MHO is under no obligation to update this document, notify any recipients, or re-publish the content contained herein in the event that nay factual assertions, assumptions, forward-looking statements, or opinions are subsequently shown to be inaccurate.

© 2022 mikehoganonline.com, All Rights Reserved